The show Science Fiction Theater 3000 takes place in the not-too-distant future where Joel Robinson is held captive by Dr. Forrester and TV’s Frank, forced to watch B-Grade movies on the Satellite of Love with the help of his robot friends: Cambot, Gypsy, Tom Servo and Crow T. Robot. It was a staple of my childhood, something my brother and I would watch at our grandparent’s house after school. Unfortunately, it went off the air before the year 2000. Equally unfortunate, we’ve continued to see the less entertaining Political Science Theater be renewed year after year. The content this show has produced largely wouldn’t have even qualified as B-Grade, and we wouldn’t have been able to hear Joel or Crow T. Robot’s hot takes. Perhaps the most unfortunate aspect of it all is that we’re all left to dissect this show ourselves, and it’s constantly on in the background no matter what channel we turn the television to instead. So, lets unpack this movie.

We’ve Seen This Movie Before

The debt ceiling was put into place back in 1917 as a mechanism of checks and balances in order to make sure the government doesn’t borrow past a certain limit. Basically, Congress wanted to avoid constantly approving new bond offerings. What was thought of as a smart and prudent budgeting device has turned into a political hostage that becomes the main character of Political Science Theater every few years.

For those who aren’t fully versed on what the Debt Ceiling is supposed to be functioning as, it’s not an act of approving new spending. No, Congress does that on its own. The Debt Ceiling is simply designed to aid the process of the government borrowing money to pay obligations that already exist. The issue is, when the ceiling is hit, and if nobody wants to raise it, then the only option the government has to meet its existing obligations would be tax revenue. That’s never a fun story arc in this show either. And it just so happens, that tax revenues this year were about 40% lower than the previous year[1].

So, where are we today? Well, the ceiling was hit back in January, and since then the government has been burning through its cash in order to pay its obligations: enter the negotiation teams stage right. Today, we’re reaching a point of government cash levels dwindling and policy makers scrambling to decide if the ceiling will be raised, extreme prioritization will be made on current obligations, or if a nuclear option by the President will be enacted (the 14th Amendment).

If this were the first time we’d seen this process unfold, then perhaps it would be worthwhile troubleshooting every possible outcome of these negotiations before the supposed Ex-Date (the day cash officially dries up) of the Treasury. But thankfully, we can take a peak at history to see where this puck is likely headed.

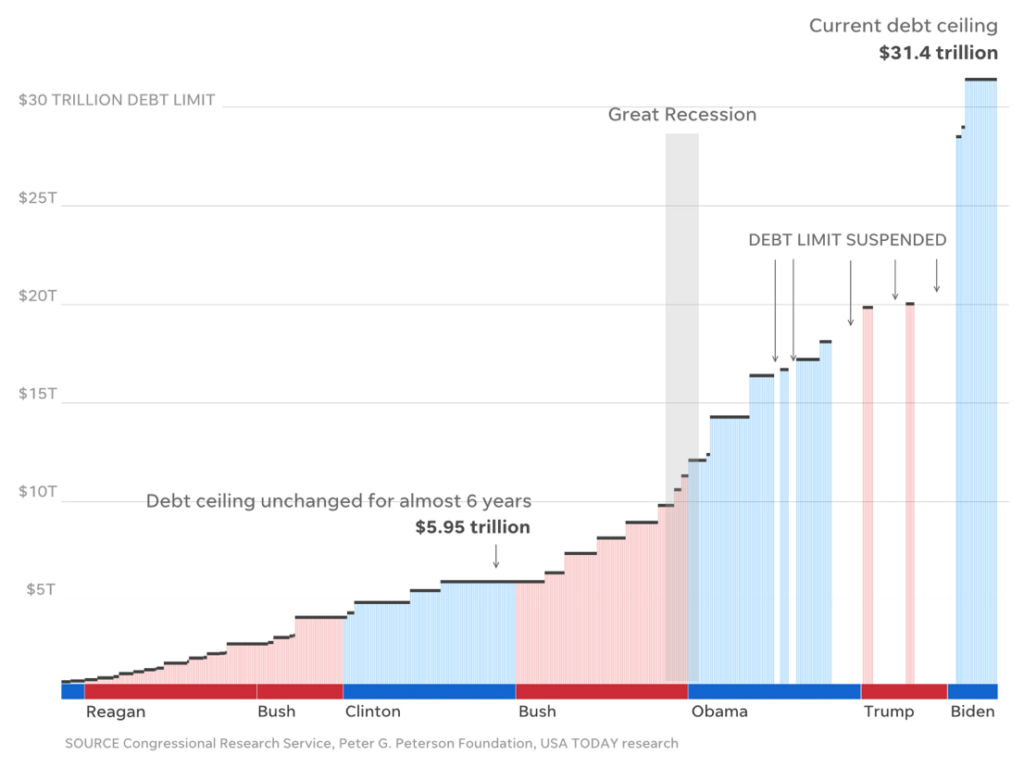

Here’s a look at each time we’ve seen the debt ceiling raised dating back to the Reagan administration:

[1] Data provided by Bloomberg database.

[2] Congressional Research Service, Peter G. Peterson Foundation

In the last 82 years, Congress has raised the debt ceiling at least a hundred times. Breaking that down by party, the debt ceiling has been raised 56 times under Republican administrations and 44 times during Democratic ones[2].

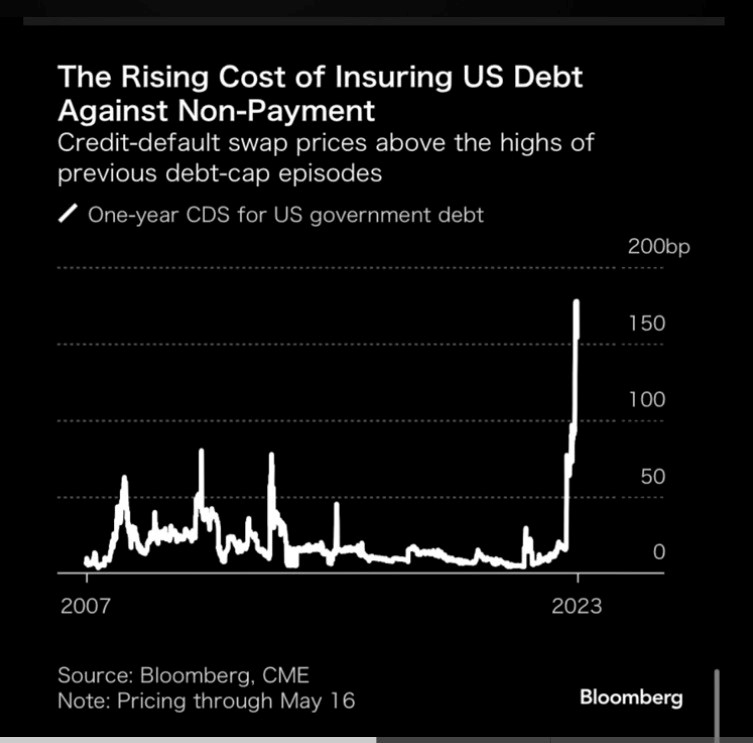

It’s a bit weird to see something that’s garnered bipartisan support historically, routinely take center stage of our political theater. But alas, such is life in the Beltway. This iteration of the story has become the “most tense standoff we’ve seen on the subject in over a decade.” For weeks, the credit default swap market has been signaling pretty damning levels of concern of the U.S. government’s credibility:

[3] Chart provided by Bloomberg database.

A credit default swap (CDS) acts as insurance for investors in cases of non-payment. The cost to insure U.S. debt is now higher than the bonds of – among others – Greece, Mexico, and Brazil, which have defaulted multiple times and have credit rating many rungs below that of the U.S.

Perhaps the CDS market should relax a little?

In recent days the latest headline that’s been thrusted into our timelines was the credit rating agency Fitch placed a negative watch on the U.S. credit rating. But lest we not forget, on August 5th 2011, S&P downgraded the U.S. government debt from AAA to AA+ when the 10-year yield was 2.6%. A year later the interest rate on the 10-year was 1.6%[4].

Today, a downgrade to the U.S. debt would ironically be a deflationary event, and boost demand for bonds. A normal credit downgrade would spur the opposite outcomes. But when you’re the world’s reserve currency and can print your own money, you instantly become the most attractive lower quality option for an investor.

The most realistic bad outcome for this whole non-event-event is a delayed payment of short-term T-Bills. Emphasis on delayed. This is why we’ve seen the yield on a 1-Month Bill fluctuate by roughly 300 basis points over the last month[5]. But if you looked just about anywhere else on the curve or in the equity market, there hasn’t been too many signals of stress. One might say that the market has been approaching this whole situation with a cool head. Maybe we’re all still in our Folklore era singing about leaving out the back door of a movie we’ve already seen.

Most investors who are finding themselves uncomfortably tense about this situation might be better off revisiting the overall risk they’re taking on within their portfolio instead of trying to find a way to capitalize off of this American tragedy, or defending themselves from it. If an event that is as routine as this one makes you feel as if you’re outside your comfort zone on the risk spectrum, the bigger conversation is about your risk tolerance, not the sequence of events that might unfold if a deal isn’t made sooner rather than later. And quite frankly, that would be a more constructive, enjoyable, and enlightening topic for all of us to focus on. Because the more in tune with our risk tolerance we are and the better aligned our portfolios are with that tolerance, the greater the chance we do not unnecessarily interrupt the power of compounding. And that’s the main goal here, after all.

[4] Federal Reserve Economic Data of St. Louis

[5] Data provided by Bloomberg database

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 5/25/2023. OPINIONS AND PREDICTIONS ARE AS OF 5/25/2023 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. DISCUSSION OF SPECIFIC PUBLICLY TRADED STOCKS IS ONLY INCLUDED FOR ILLISTRATIVE PURPOSES ONLY AND NOT A RECOMMENDATION. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.