George Bailey was just married and on his way to his honeymoon when his driver was stopped by people running in the streets towards the bank. A literal bank run had broken out and George beelined it to the bank he operated, only to find a horde of customers locked out of the building. These people wanted their money, and nothing other than every cent that they’d deposited into George’s bank- which focused on underwriting construction loans. The problem was George’s bank didn’t have the money. Not only because Mr. Potter had called on their business loan, while simultaneously spreading a rumor that George was insolvent, but as George tried to explain to the distraught customers, their money wasn’t tucked away in a safe. “The money’s not here! The money’s in Joe’s house, and the Kennedy house, and one hundred others!” George’s customers were more interested in selling their shares in the bank at a 50% discount to Mr. Potter, than not accepting any of their dollars in that exact moment. George’s wife swiftly proposed handing out cash from their wedding as a place holder of their principals. George Bailey’s own bailout saved his business for the afternoon, but the solution only compounded the moral hazard that was underneath the surface of the bank run scene. This week, we’ve seen a real life (and in color) bank run for the first time in quite a while. While the one depicted in It’s A Wonderful Life is fictional, the one actually happening in Silicon Valley is emblematic of the same moral hazard.

Mismatched Portfolio Management

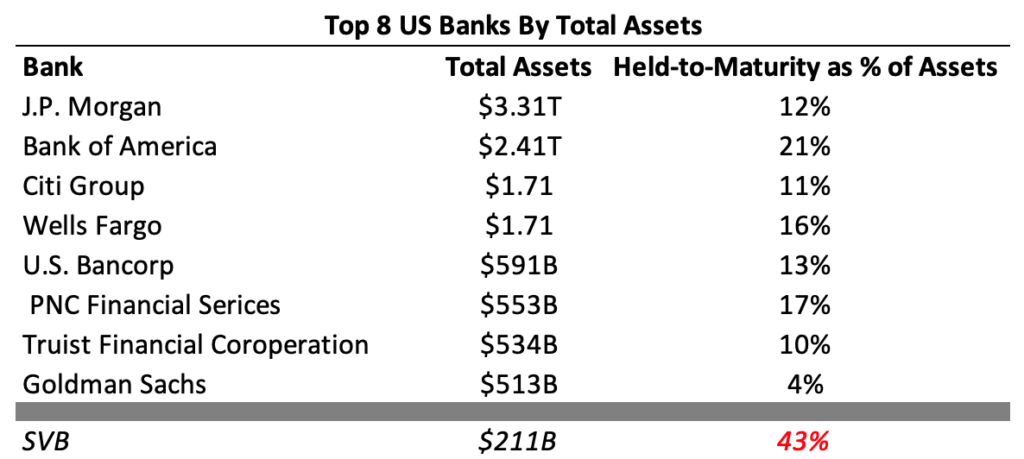

The backdrop for the SVB situation is one of a bank that grew deposits and assets at an astronomical rate- nearly tripling from 2019-2022 to $198B- as the technology bull market became a full-blown bubble across the VC landscape. This compares to an industry growth rate of 37% [1]. Just like any other bank, SVB had to put their deposits somewhere. But unlike George Bailey, SVB opted for the “safest” asset that they could find- intermediate-term Treasuries, mostly. SVB attempted to build a barbell like strategy: to shelter some of its liquidity in shorter duration available-for-sale securities, while reaching for yield with a longer duration held-to-maturity book [2]. On a cost basis, the shorter duration Available-for-Sale (AFS) book grew from $13.9 billion at the end of 2019 to $27.3 billion at its peak in the first quarter of 2022; the longer duration Held-to-Maturity (HTM) book grew by much more: from $13.8 billion to $98.7 billion [3].

This sounds innocent enough, but when you realize the average 10-year yield over this time was 1.86%, you start to find yourself in a sticky situation. “Based on the current environment, we’d probably be putting money to work in the 1.65%, 1.75% range,” said the bank’s CFO at the beginning of 2022, referring to the yields he wanted to achieve [4].

Low yields and a flat curve don’t exactly reward an investor for taking on such duration risk within their portfolio. Taking on such duration might be fine when you’re dealing with a Type I liability (i.e., your liability has a known amount and time before coming due). But when you’re dealing with primarily Type II and Type III Liabilities (i.e., known amount and unknown timing, or unknown amount and unknown timing), one could argue it’s a bit careless to take on certain levels of interest rate risk, without having a justifiable reward. The duration of Silicon Valley’s HTM portfolio extended to 6.2 years, at the end of 2022, and unrealized losses had amounted to 17% [5].

Set aside the unrealized (at the time) losses on the HTM portfolio. The idea that SVB was comfortable with the level of duration exposure they were carrying, given the underlying profile of their deposits, is one of the more fatal mistakes in the bank’s risk management process.

[1] SVB corporate filings, as of Q4 2022.

[2] Seemingly, SVB failed to hedge their duration exposure with interest rate swaps.

[3] SVB corporate filings.

[4] SVB corporate filings.

[5] SVB corporate filings.

[6] Chart provided by J.P. Morgan

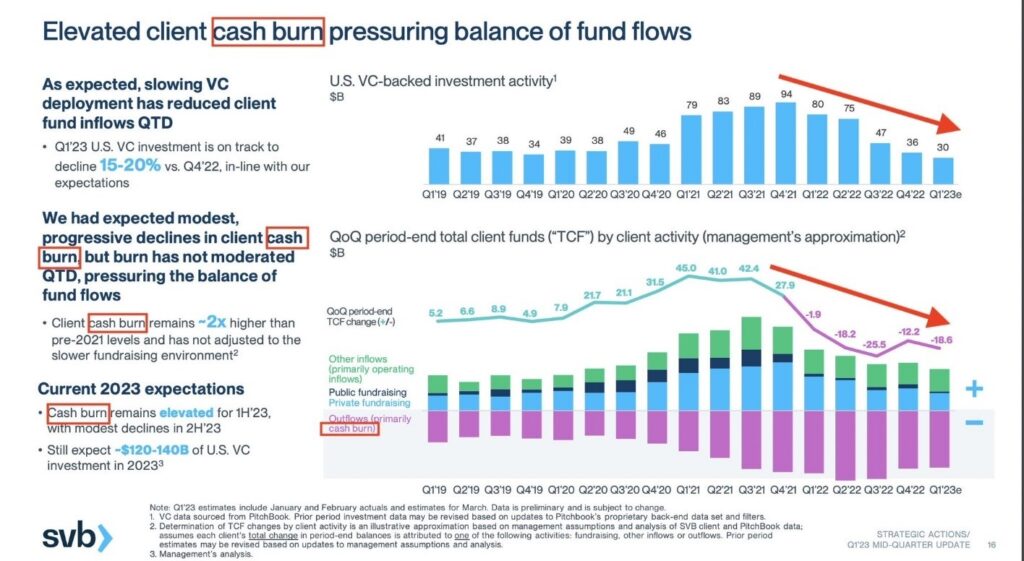

Who was SVB notably attracting as a customer base? Money-losing companies backed by venture capitalists. What’s a feature, not a bug, of these businesses? They required constant inflows of venture capital funding which stopped, and as the flow of venture capital (VC) funding slowed to a trickle, the cash balances of companies who banked with SVB dwindled, so SVB suffered deposit outflows for ALL of 2022.

[7] Charts provided by SVB corporate filings.

Deposit outflows for the entire calendar year, yet no meaningful attempt to shorten the duration profile of these assets across the HTM portfolio. Only then did the losses on SVB’s securities become a problem. Now, investors will be forced to deal with counterfactuals regarding unrealized losses on HTM portfolios across the banking sector. When in reality, nobody should be carrying a customer base that looked like SVB’s and has been so cavalier about the risks under the hood.

It’s not SVB’s fault that VCs were showering founders with record levels of cash. It’s also not their fault that founders were led to believe they could continue to be rewarded for increasing cash burn in the name of growth.

Now that the Fed Funds Rate has gone up almost 500 basis points in the last 12 months, those bonds (along with everyone else’s) are down in price. At the same time, there have been virtually no IPOs or exits for their clients [8] (founders and VCs) and the cash burn rates at these businesses have necessitated the ongoing withdrawal of funds from their SVB accounts- now that the spigot of VC funding rounds has tightened up.

But the last 12 months have seen the Federal Reserve spike rates up at a record pace, and the shift in sentiment across startups and VCs has turned towards austerity. This means these companies are drawing on their cash deposits at a higher rate than before. But as the nature of fixed income goes, the deposits that SVB invested across their bond portfolios have experienced a considerable drawdown in value- yields up, prices down.

So, what did SVB do? They decided to sell a chunk of their HTM portfolio assets ($21B, resulting in a $1.8B loss, which is more than their total net income of $1.5B [9]) and attempt a capital raise (~$2.5B in equity, common and preferred) to account for the funding gap. This set off a chain reaction that led to a classic run on the bank as many prominent venture capitalists began telling their portfolio companies to move their money away. While not so shamelessly publicly preaching others to remain calm. The last couple of days have proven to be a valuable time for everyone to be familiar with the dynamics of the prisoner’s dilemma.

It’s fascinating to see such a panic unfold, when there wasn’t a noticeable amount of toxicity sitting on SVB’s balance sheet. This isn’t a replay of Lehman. There’s no noticeable ignorance by the creditors here. The bank was buying government backed securities for goodness sakes. I’m not being careless with those statements either. SVB was [10] a bank with 15% Tier 1 capital, 40% LTV, and more than 100% deposit liquidity coverage [11]. Bank failures typically are a credit event, you will be hard pressed to find a bank collapse that was centered around duration mismanagement.

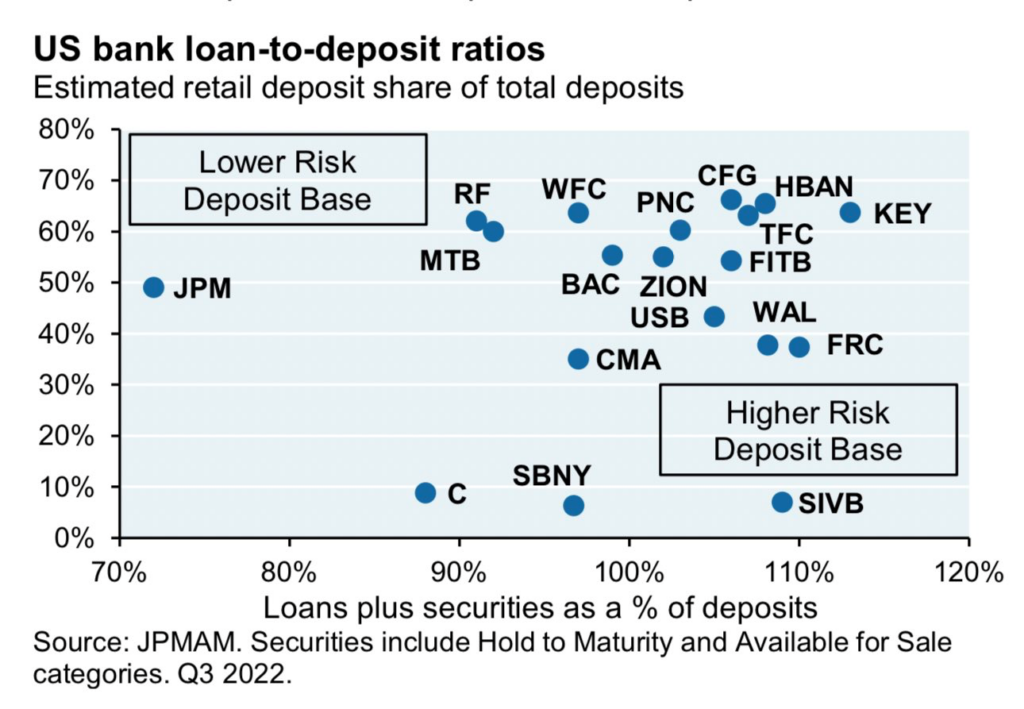

For perspective, banks back in the financial crisis were running books with much less safe capital (low single digit Tier 1), much higher LTVs (some >100%) and holding extremely risky securities in their books (CLO, ABS, etc). What you’ve seen unfold this week is nothing like the Great Financial Crisis. A big reason why is that the regulators have totally changed the way that banking is done in the US over the last 15 years. Banks are no longer the high leverage, risk taking institutions they were. They are well capitalized ‘boring businesses’ these days. But boring doesn’t mean absent of risk. If you are still concerned about the risk of contagion, or recently found yourself in the market for a new banking partner, take a look at this table [12]:

[8] IPO deal proceeds plummeted 94% in 2022, according to Ernst & Young’s IPO report published in mid-December.

[9] SVB corporate filings, as of Q4 2022.

[10] In the time of beginning and finishing the blog post, the FDIC has seized the assets of SVB and forced it to shut their doors, as of 3/10/2023.

[11] SVB corporate filings.

[12] Data provided by Bloomberg database.

The risk-free rate doesn’t absolve a portfolio from risk. You could purchase an IOU from God themself if you’d like. But if your own liability and asset alignment is, well, poorly aligned; then you’re not absent of risk in your portfolio, your business, or your life for that matter. A lesson that bankers, CFOs, founders, and individual investors alike should be taking away from all of this.

To be clear, SVB isn’t alone here. They’re just the biggest bank within the innovation and tech hub that is Silicon Valley. Their customers make up roughly 50% of all VC backed companies in the United States [13].

That still means there are other banks out there that make up the rest of that 50%. Other banks that have lent to or supported technology entrepreneurs and startups are going to be at risk before the storm passes.

Beyond Silicon Valley, and startup boardrooms across the United States, this event has largely influenced headlines thus far. Absent a mass liquidation in the passive ETFs across the financial sector, and regional banking ETFs, we haven’t seen a large-scale flight to safety. Here’s a look at the U.S. dollar, which has acted as a safe haven for capital over the last twelve months:

[13] SVB corporate filings, as of Q4 2022.

[14] Chart provided by AllStar Charts.

Stocks have sold off in response to the news. The VIX has shot higher over the last couple of days. Bonds have rallied, sending yields lower. But the dollar is failing to breakout above recent resistance. Is it because the first sign of something that’s seemingly more than a crack in the system has presented itself, and is leading investors to believe the Fed might not strike such a Hawkish tone moving forward? Who knows, really. But a lack of follow through shown in the USD, might just be enough to comfort investors for adding to risk asset positions here in segments of the market that look to be well insulated from this fallout.

There is no shortage of big picture questions that remained left unanswered here. Specifically for investors exposed to the VC asset class- be it directly or tangentially. Second and third order effects will continue to reveal themselves over the next few weeks. But it will take likely a handful of years to really answer the question how will the VC ecosystem change over time without SVB. The cost and ease of doing business has to be going up for these funds and their portfolio companies. Everything from fundraising to lines of credit. Silicon Valley Bank sought to serve the VC ecosystem, and the VC ecosystem took down Silicon Valley Banks. There’s a lesson in that for everyone.

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 3/10/2023. OPINIONS AND PREDICTIONS ARE AS OF 3/10/2023 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. THE S&P 500 INDEX IS AN UNMANAGED INDEX, WHICH IS WIDELY REGARDED AS THE STANDARD FOR MEASURING THE U.S. STOCK MARKET PERFORMANCE. THE VIX INDEX IS BASED ON OPTIONS OF THE S&P 500 INDEX AND IS RECOGNIZED AS THE WORLD’S PREMIER GAUGE OF U.S. EQUITY MARKET VOLATILITY. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.