The debate of who belongs on the investing world’s Mount Rushmore carries no shortage of candidates who’ve earned their way into conversation. Names of the likes of Graham, Dodd, Schloss, Buffett, Lynch, Miller, Klarman, Marks, Dalio, etc. Each of these investors have had unique and exceptionally extraordinary success in the markets throughout their careers. One name came along and altered the foundation of the investment environment as we know it: Bogle. Now, we’re not trying to make Mr. Bogle to come across as a villain in this story, but he is arguably one of the largest reasons that investors of the former’s breed is few and far between today. In a world of indexing, investors (retail and professional) have had an increasingly tougher time showcasing their skill and beating the market. This hasn’t stopped many from trying. One of the many common denominators the best have shared, is the fact that they are comfortable looking nothing like anybody around them. We think that’s one of the most important factors of the formula to add alpha today.

WHAT’S YOUR OBJECTIVE?

For most investors, carrying a diversified portfolio that is designed to follow a personal financial plan laid out by an advisor is the smartest thing they can do. Generally speaking, when we sit down with investors to discuss what their individual and family’s goals are, we hear a list of objectives that are likely to apply to all of us: save for retirement, plan for education funding, purchase a home, prepare for the next generation. We almost never hear anybody say, “I’m talking to you because I want to beat the market.” For some, this is a thought that lives in the back of their mind that they refrain from speaking into existence. We don’t think investors should be ashamed of this. Usually this stems from a life-long passion of investing, following markets and reading books written by the names that are nominated for Mt. Rushmore. What if we told you it’s okay to want to beat the market? And it’s even more okay to try? (In moderation, of course.)

KNOW WHAT YOU KNOW

Our professional backgrounds claim their origins squarely in the camp of fundamental security analysis. When this is where you’re born and raised (Graham-and-Doddsville adjacent), the thought of beating the market isn’t exactly in the back of your mind, it’s all around it. Like Zach Galifianakis crunching numbers at a card table, generally speaking it’s a question that we’re constantly trying to find the answer to. In attempt to answer that question, we believe the first thing we must do is clearly identify the investment factors, that make sense to us, that can lay way to reaching this goal. As is the case for anybody managing an investment portfolio, setting the guardrails for what you are looking to include in the portfolio will help breathe consistency into your investment process.

Doing the homework necessary is the obvious other piece of the formula. If you’re going to try to identify the handful of individual names that you think carry the qualities you deem necessary to add alpha, becoming as close as you can to the company in question is a must. Intuitively, this is a disadvantage to any retail investor who’s hoping to pick winners. Fundamental analysis requires time, training, experience and resources that most who are not full time professional investors do not have. And those are just the tangible requirements.

THE INTANGIBLES

Textbook, academically inclined analysis isn’t enough. Intuition and imagination can go a long way in investing. Remaining independent and blocking out as much noise as we can is crucial in order to succeed. Nate Silver said it best, “Distinguishing the signal from the noise requires both scientific knowledge and self-knowledge: the serenity to accept the things we cannot predict, the courage to predict the things we can, and the wisdom to know the difference.”1 Allowing for yourself to remain independent in analyzing the information we’re all provided as public market participants is key. We think there are two dangerous assumptions about public information that seem to not allow for subjective intangibles to play a part in investing: A) Assuming everyone knows what you know, when you know it, just because it’s public is an egregious assumption; and B) Assuming the market has perceived this information and these opportunities in the same light you have. Markets as a whole tend to be leading indicators, but we feel humans in general are more likely to be reactive than proactive. Allowing for your personal thought process to separate from the herd is key.

The final three intangibles we think these winners possess are patience, conviction and a competitive mentality. Possessing the patience to not act when Mr. Market is doing his best to force your hand is paramount. We think patience and conviction are nearly two in the same. Buffett has been known to make reference to Ted Williams, one of the greatest baseball players of all time. Williams’ ability to hit a baseball has gone unmatched even through the modern era on many levels. Ted Williams was the last player to hit .400 over the course of an entire season in 1941. He did it by going 6-8 in a double header against Philadelphia on the final day of the season.

Among the baseball community and historians, it’s been widely discussed that Williams used to keep a log of his at-bats, tracking his success rate on certain pitches around the strike zone. Don’t believe it? The investment industry has happily adopted the statistic known as batting average to measure a portfolio manager’s ability to outperform their respective benchmark. Just look at that heat map. Ted (we’re on first name basis) knew what he knew, he knew what he was looking for, he did his homework and he was patient.

Among the baseball community and historians, it’s been widely discussed that Williams used to keep a log of his at-bats, tracking his success rate on certain pitches around the strike zone. Don’t believe it? The investment industry has happily adopted the statistic known as batting average to measure a portfolio manager’s ability to outperform their respective benchmark. Just look at that heat map. Ted (we’re on first name basis) knew what he knew, he knew what he was looking for, he did his homework and he was patient.

Like Williams, an investor seeking to beat the market must carry an unfaltering competitive nature with them. Thinking you can’t accomplish something because so many people are competing with you overestimates the average human work ethic. And likely accurately estimates your DNA. If you show up without ever intending to identify an opportunity that makes a material difference to a portfolio, you’ve already lost. If you just go through the motions of trying to add alpha, then you get eaten alive by the market. An investor who possesses the appropriate DNA wouldn’t blame the competitive nature of markets for never trying.

So where does all of this leave us as a firm?

ENTER THE GFG FOCUSED GROWTH STRATEGY

Four years ago, we set out to carry an offering for our current and prospective clients that is designed to scratch this itch. How much of it is our itch and how much of it is the clients’ itch is up for debate. We sat down and asked ourselves some tough questions that challenged out intellect as well as our spirit. The result was an investment strategy designed to bring the additional alpha to an investor whose profile allows for it.

The GFG Focused Growth Strategy is a highly concentrated equity strategy with one purpose: beat the S&P 500. With this goal in mind, we’ve identified investment factors that we feel are commonly found in market leaders that we want to target within the companies we take a position in. Acknowledging the need for conviction within an investment thesis, as few as eight names within the portfolio. We think the true value in concentration is being able to maximize your upside potential through position sizing. Diversifying away just enough of the idiosyncratic risk within the portfolio is what we aim to do, but we never want to effectively turn into an index fund. This type of conviction and concentration is seldom found in the market today. (Why that is, is subject for a different blogpost on closet indexing.) But this type of conviction is very common among history’s biggest market winners. Allowing for this type of strategy management within a portion of one’s portfolio is a luxury most cannot tolerate. But for those who can, we think this is a viable solution to help bring structure to the process of trying to scratch that itch.

How’s GFG’s philosophy and portfolio worked out since its origin?

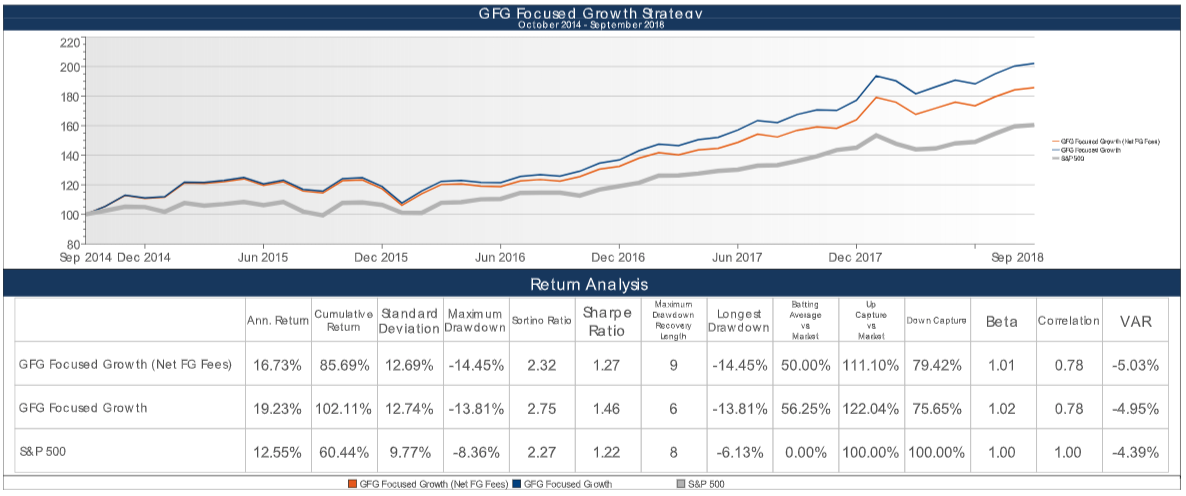

In the four years since inception (October 1, 2014) the model GFG Focused Growth Strategy has returned more than 100% vs 59.53% of the S&P 500 on a total return basis. Absolute return in one thing, on a risk adjusted basis the Focused Growth Strategy has generated a Sharpe Ratio of 1.46, a Sortino Ratio of 2.75 and a VaR of -4.96%. This is relative to the S&P 500 which has carried a slash line of 1.22/2.28/-4.45% respectively2.

PORTFOLIO MANAGEMENT

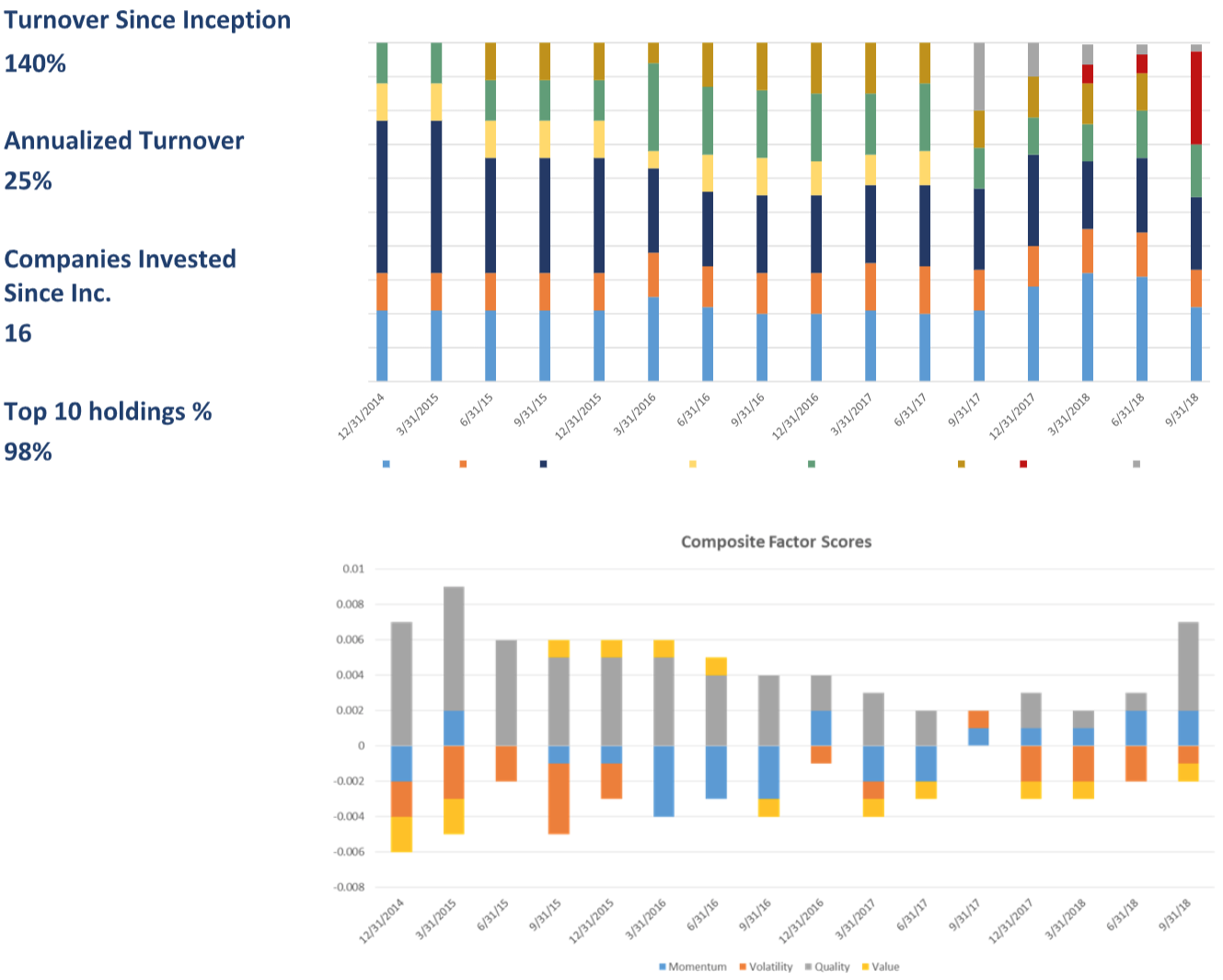

Seeing performance like that might be staggering for some. Some immediate questions that come to mind might be turnover or overexposure due to the concentration. But the results in our view are a byproduct of the investment process we’ve deployed until this point, as well as the individuals responsible for execution. Those characteristics we listed are running through our investment team’s head each and every day. As for the portfolio’s characteristics, below highlights some historical portfolio management details:

WINNERS WIN

For most, being able to dedicate the time, energy and resources to a passion like this isn’t a viable option. What we think is a viable option is allowing for investment professionals to bring not only structure, but the right characteristics to the table in order to execute on this goal in a meaningful way. We’re not on Mt. Rushmore (yet). But we’ve taken the first step to making it there, and that’s compete.

This presentation is solely for informational purposes and should not be taken as investment advice. For further information, please contact one of our investment adviser representatives.

Sources:

1 The Signal and the Noise, Nate Silver

2 “Net FG Fees”: All Performance shown is of the model GFG Focused Growth Strategy on a net of management and performance fee level.

Graphs made by GFG Capital. Data provided by Bloomberg Database. Please see disclaimer in the back of this presentation for additional performance disclosures.