If Martin Fridson were updating his classic, It Was a Very Good Year, today he might struggle to categorize 2025. In 1928, the mood was euphoria. In 1999, it was hysteria. In 2025? It was mostly anxiety.

Yet, the scoreboard doesn’t care about our feelings. As we close the books, the S&P 500 is on pace for its third consecutive year of 15%+ price growth, flirting with a 20% print. We have seen a “Three-Peat” of 15% gains only twice since the Coolidge administration (the late 90s and the post-COVID rebound).

Usually, returns of this magnitude are accompanied by party hats and champagne. This year, they were accompanied by ulcers. That divergence—between price action and sentiment—is what makes this vintage unique.

Climbing the Wall of Worry

Fridson’s analysis often looks for the “fatal flaw” in a boom year—the blind spot investors ignored. But in the second half of 2025, we didn’t have blind spots; we were staring directly at the risks.

Sentiment soured significantly in H2. We spent months obsessing over the sustainability of the AI trade, specifically when the financing shifted from balance sheet cash to debt issuance. In previous bubbles, the market would have cheered the leverage. In 2025, the market applied a discount. When spreads widened on tech issuance, stock prices corrected.

This is not the behavior of a bubble; it is the behavior of a rational, skeptical pricing mechanism. We haven’t been riding an “escalator of complacency”; we have been climbing a classic Wall of Worry, brick by brick. And as any veteran trader knows, bull markets don’t die when people are worried. They die when people stop worrying.

The Engine: The “E” Actually Showed Up

In Fridson’s analysis of 1928 or 1999, the “Fatal Flaw” was usually a divorce between price and reality. The market went up simply because people were willing to pay more for the same dollar of earnings (multiple expansion).

2025 defied that template.

If you assumed this year’s 15-20% gain was all hot air, check the math. The heavy lifting wasn’t done by hype; it was done by the bottom line. S&P 500 earnings grew by a robust 12% this year, providing a concrete, steel-reinforced floor to the rally.[1]

Even more surprising is the “Tech Bubble” that wasn’t. Despite the breathless coverage of AI, the Nasdaq-100 (NDX) is set to finish the year trading around 25x forward earnings.[2] In a vacuum, that sounds expensive. In context, it is arguably boring—it is largely inline with its average multiple over the last seven years. This isn’t the “growth at any price” mania of the dot-com era; it is “growth at a market price.” We aren’t paying for eyeballs; we are paying for cash flow, and for the first time in a long time, we are actually getting it.

[1] Data provided by Factset.

[2] Data provided by Bloomberg database.

The Warning Light: The 2-Sigma Problem

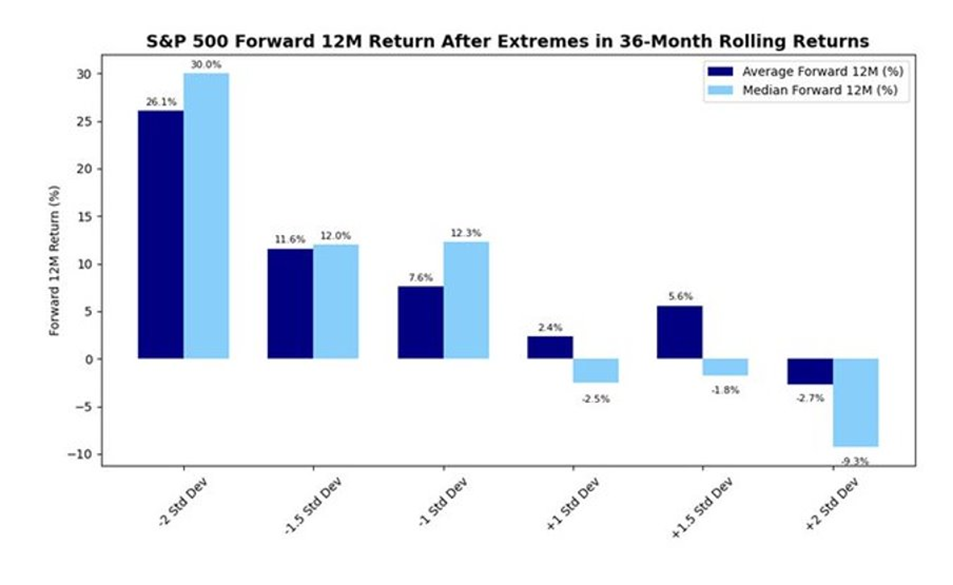

Here is the chart that you should chew on for a bit:

When the market deviates 2 standard deviations above the norm, history suggests the subsequent 3-year annualized returns are… uninspiring. Usually flat to negative. The market is a mean-reverting beast. It hates outliers.

In the late 90s, the “3-peat” of 20%+ returns was followed by the “Lost Decade.” In the post-COVID boom, we paid for our 2021 excess with the 2022 bear market. 2025 feels different because the volatility (VIX) has remained comatose. Investors have been lulled into a sense of inevitability. We aren’t climbing a “wall of worry” anymore; we are taking an escalator of complacency.

[1] Chart provided by HB Wealth.

The Verdict on the Vintage

So, how does Fridson’s history judge 2025?

It belongs in the chapter of “Justified Booms.” It shares DNA with 1954—a year where a post-war economy finally convinced the skeptics it was real. The market has absorbed a shift in AI financing, a moody consumer, and a “No Landing” macro backdrop, and it has churned out 20% gains despite it all.

The 2-sigma extension in rolling returns is notable, but it shouldn’t be viewed as a stopwatch counting down to a crash. Instead, view it as evidence of momentum. In physics, an object in motion stays in motion unless acted upon by an opposing force. Right now, the opposing force—skepticism—is already present, and the market is absorbing it.

As we head into 2026, the data suggests we don’t need to run for the exits. We just need to acknowledge that the “easy” comparisons are behind us. The market has proven its resilience; now it just has to maintain its discipline.

IMPORTANT LEGAL DISCLOSURES

CURRENT MARKET DATA IS AS OF 12/31/2025. OPINIONS AND PREDICTIONS ARE AS OF 12/31/2025 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.