China’s tech sector has been in the headlines in recent days for three key reasons: a) ownership structure, especially after China’s education sector was massively impacted by the new guidelines by the government, b) regulatory risk on new policies regarding user data, and c) heightened oversight on business practices. Most of China’s tech companies in the software space operate as a VIE structure. Hence, investors are understandably concerned on whether the government’s recent education sector guidelines to restrict foreign ownership of education companies in China, including through VIE structure, would be a concern extrapolated to the tech sector.

Domestic Antitrust

Our view on these headlines is that while this would imply greater competition between these companies and some dilution of benefits that come from locking users to one ecosystem which does not “talk” to another ecosystem, it would nonetheless also give greater opportunities to these companies to access the best of other platforms and enhance services over time. In line with this, Bloomberg reported recently that Alibaba and Tencent could consider opening up their platforms to each other’s services and hence address some of the regulatory concerns on use of big-data and potentially monopolistic practices given the huge customer base that these companies have in their ecosystems. We are not dismissing this news and think this could actually materialize in the near to medium term, in our view.

Implications: While these regulations do imply that the exclusivity benefits that large technology platform companies currently enjoy may have to be diluted, we do not think that it is a one-way conclusion with smaller players benefiting from the opening up of larger players’ ecosystem, here. Rather, we think it would involve greater competition across the board for all players and where the larger companies would still have stronger balance sheet strength to ride through the increase in competition. For the near term, we think companies may increase their marketing budgets as they may be able to tap into one another’s ecosystems.

1 Bloomberg.

(Crisis = Opportunity)

U.S. Delisting

Another concern has been around escalation of US-China tensions which in turn has implications for continued listings of Chinese companies, including the tech sector companies, in the US exchanges. US-listed Chinese companies have been under close scrutiny by US policymakers for the last few years, culminating in a new law passed by Congress last year that could disqualify foreign companies from listing shares on US stock exchanges. We initially commented on this issue in May 2020. We reiterate that we feel none of the Chinese company exposures within our portfolios today are at risk to delisting given their track record of compliant accounting practices. Alibaba is Battletested Regulatory risks have persisted with Alibaba time and again. The company had to work aggressively on the “brushing issue” back in 2015 which involved merchants using fake orders to raise their profile, and also the fake products issue around the time, and the company responded by aggressively taking down products. More recently and earlier this year, Alibaba subsidiary Ant Financial’s IPO could not proceed, and the company was fined $2.8 billion for anti-trust behavior. Alibaba mentioned that it plans to reduce fees for merchants and invest in more products and services in its offerings.

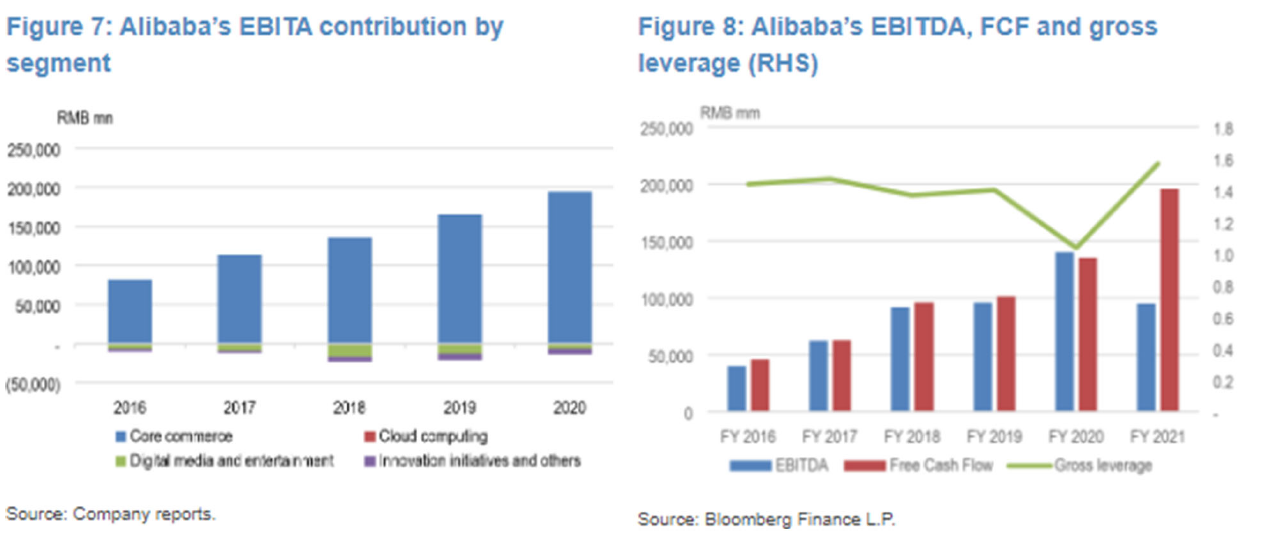

We’re constructive on the fact that Alibaba’s management has taken a very proactive approach to work with the regulators on the solutions. We do not think the fines would impact the company’s credit profile given its $30-$35 billion in operating cash flows and strong net cash position, which apart from the $100 billion figure, as of Mar-21, does not take into account the large monetizable investments the company has, in its key subsidiaries such as Ant Group.

For Alibaba, key upside catalysts are strong profitability in the core ecommerce business, further asset monetization of new businesses, etc., while key downside risks are higher regulatory headwinds on core business.

Education Crackdown

We believe the crackdown on education is an industry-specific regulatory effort, despite the fact that China Internet is also undergoing regulatory scrutiny. As such, we believe the implications for China Internet are more on sector operation and less on sector regulation. For example, online ads are likely to be negatively affected as education was one of the largest advertiser categories in the past couple of years. Nonetheless, the impact on Internet operators’ share price should be limited as 1) ads are not the share price drivers of many Internet operators (i.e., Tencent). We think one of the reasons behind the education crackdown might be attributable to teenager protection, which is related to online digital entertainment. Therefore, a plausible argument can be made that online gaming could potentially be further regulated now that teenagers may end up with more spare time. This was a focal point for the PBOC in 2018, and at the time Tencent complied with the elevated scrutiny and has continued to enhance their anti-addiction monitoring systems since. We think the implications for Internet are more on the sentiment side. Tencent is one of the key sector sentiment barometer stocks. The stock is trading below its conventional range of between 25x-35x 12mfwd PE and in line with the valuation in late 2018 when sentiment tanked on gaming monetization approval suspension.

2 Graph provided by Bloomberg.

LEGAL STUFF

INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED. CURRENT MARKET DATA IS AS-OF 8/5/2021. THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISOR. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS. OPINIONS AND PREDICTIONS ARE AS OF AUGUST 2021 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED, THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT. THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/. ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.