Credit rating agencies didn’t exactly make it through the Great Financial Crisis with the most stellar reputation. Many investors who were active in the market at the time felt there was a bit of a blind eye, or apathy, paid towards some of the insidious lending that was taking place in the leadup to the housing bubble. It was as late as April in 2008 that Fitch affirmed their AA- rating on Lehman Brothers, just for the lender to fail on September 15th that year [1]. Those who feel the role of these agencies hasn’t been fully fulfilled aren’t coming from a place with no basis. It was a few years after the Great Financial Crisis that S&P downgraded the United States from AAA to AA+ rating. Since then, rating agencies have largely avoided the headlines. Until now, when Fitch decided to downgrade the U.S., for nearly the same reasons cited in the S&P’s report over a decade ago.

[1] Fitchratings.com

Creditworthy

On August 5, 2011, S&P downgraded its rating on U.S. credit from AAA to AA+. From their statement at the time [2]:

“The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics. More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned when we assigned a negative outlook to the rating on April 18, 2011.“

[2] S&Pglobal.com

Here’s Fitch this week [3]:

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

[3] Fitchratings.com

The decision to downgrade the U.S. in 2023, while citing the debt ceiling sideshow, and refer to the January 6th, 2021, insurrection feels weirdly political, let alone delayed. Not to mention, the origin of the agency itself pre-dates the concept of the debt ceiling. I’m not defending the debt ceiling, but how could an agency that has seen the debt ceiling since its origin wait 106 years after it was introduced to claim it was a mechanism that was worrisome enough to be the central point in a downgrade?

Believe it or not, back in 2011 the United States Congress was entangled in a public spat regarding the debt ceiling. (I know, nothing so far seems unprecedented, other than the J6 reference.) Also back then, there wasn’t a massive selloff in U.S. Treasuries. So, investors should not expect a mass exodus, or rerating of the U.S. paper because of this report either. That’s partially due to the sheer volume of assets held across the world that are either denominated in USD or are Treasuries themselves. Being the world’s reference currency carries a bigger weight than an arbitrary credit rating. We think there are factors that not only us, but many others across the global market are focused on when it comes to the attractiveness of U.S. debt within a portfolio.

Here’s a few:

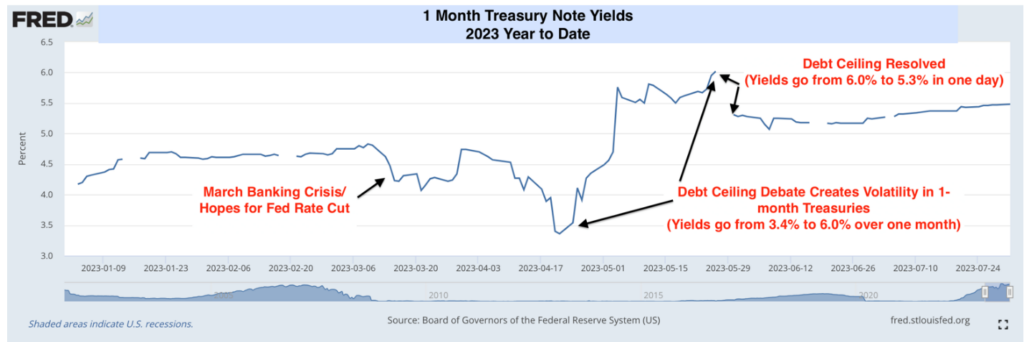

First, it is a belated acknowledgment of actual capital markets conditions. The chart below shows how 1-month Treasury bills have traded this year. In a world where Treasuries are supposed to be risk free assets, this shortest maturity obligation should be the safest paper on the planet.

[4] Chart provided by FRED, as of 8/2/2023.

And yet, Treasuries failed in that role earlier this year. As the April-May debt ceiling debate unfolded, 1-months went from 4.5% to 3.4%, and then to 6.0%. Once there was a deal, they fell from 6.0% to 5.3% in one day. That tells us markets place non-zero odds on a technical default, essentially saying Treasuries are not absolutely risk free.

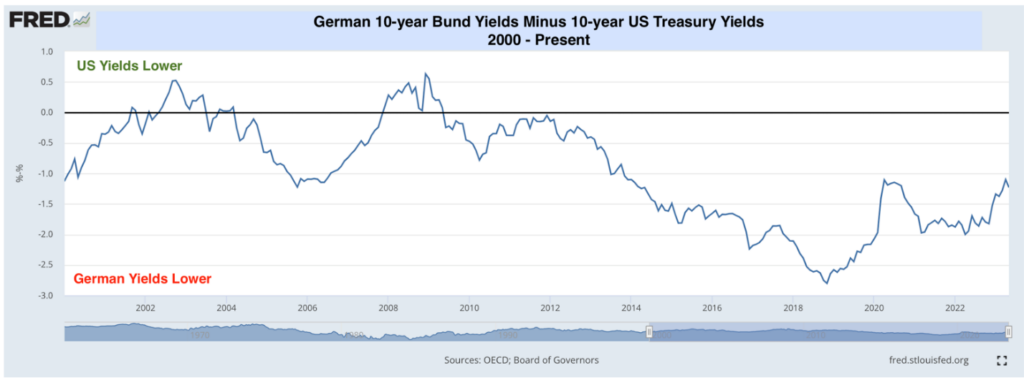

Second, US Treasuries haven’t been the world’s “safest” securities since 2009 (German bunds hold that title), and there hasn’t been too much of a signal from the actual economy that it’s mattered. The following chart shows the difference between German 10-years and US 10-years. German yields have been consistently lower since the end of the 2008 – 2009 Financial Crisis and Great Recession. And yet … Since 2010, the German economy has grown by 19 percent in real terms, while the US economy has grown by 32 percent over the same period. Yes, deficit spending has helped the American economy a lot. But it is the sustainability of those deficits and the market’s pricing of Treasury paper that matters, not credit ratings per se.

[5] Chart provided by FRED, as of 8/2/2023.

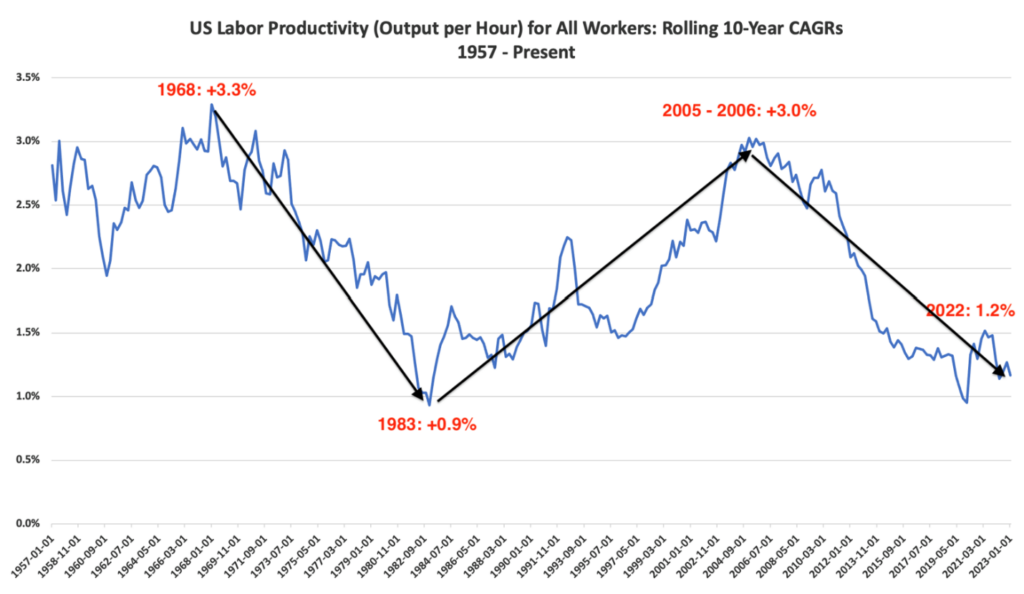

Third, we worry a lot more about productivity growth than debt ratings when it comes to longer run US equity returns and debt service expense. Output/worker is important to both corporate profits and America’s ability to comfortably service its financial obligations. With population growth of less than 1 percent, increasing productivity is now the primary driver of earnings/wage growth and tax revenues. As the following chart of 10-year compounding rates for US productivity shows, the last decade has been exceptionally bad. It needs to improve, or there will certainly be more US government debt downgrades in the future.

[6] Data provided by FRED, as of 8/2/2023.

Fitch’s downgrade reflects a reality that investors have already learned to accept so, while the initial equity market response was negative, it does not add anything new to the discussion. US equity markets are already on unsteady ground and could continue to be so for another month or two. This just so happens to be a seasonally weak point of the year, as well as the four-year presidential cycle the markets manage to respect coincidentally enough. We shouldn’t be too surprised if we see the market take a bit of a breather from here, and perhaps consolidate and retest some moving average before the summer vacation periods are through.

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 8/3/2023. OPINIONS AND PREDICTIONS ARE AS OF 8/3/2023 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. THE S&P 500 INDEX IS AN UNMANAGED INDEX, WHICH IS WIDELY REGARDED AS THE STANDARD FOR MEASURING THE U.S. STOCK MARKET PERFORMANCE. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.