The financial press has focused considerable attention on rising bond yields this week, with 30-year Treasury yields touching 5.1% and prompting comparisons to crisis periods. Before drawing parallels to Liz Truss’s brief tenure or invoking bond vigilante narratives, the data suggests a more measured assessment is warranted.

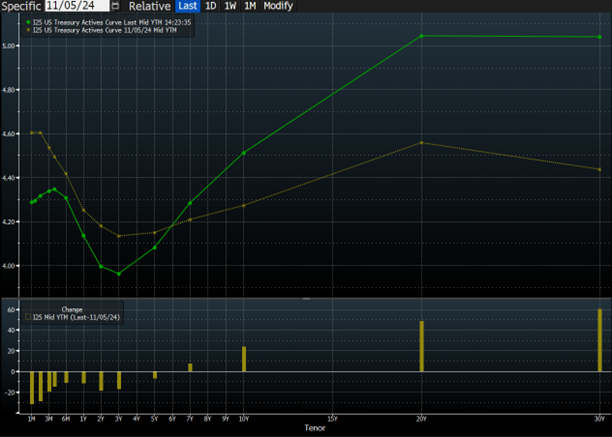

The broader Treasury market performance tells a different story than the headlines suggest. Intermediate-term government bonds are up 2.5% year-to-date and delivered positive 5.5% returns over the past twelve months. The average weighted maturity of outstanding Treasuries sits around six years, and from that perspective, we’re experiencing a modest 1.9% drawdown from April highs rather than systematic distress. In fact, yields are lower today at 10 of the 14 points on the yield curve than where they were on Election Day last year.

[1] Chart provided by Bloomberg database. Data as of 05/23/2025.

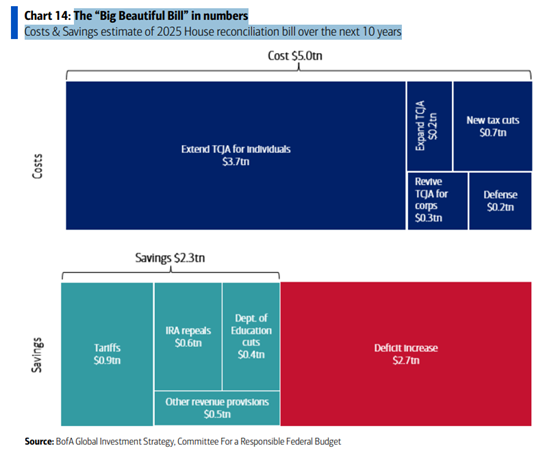

This doesn’t diminish the fiscal policy questions at hand. Trump’s tax legislation would add nearly $4 trillion to the deficit over the next decade according to Congressional Budget Office estimates. The administration’s growth projections of 3% annually versus the CBO’s 1.8% echo optimistic assumptions we’ve seen before. Interest on the public debt exceeded $1 trillion for the first time during the fiscal year ended September 30, making it the second-largest federal expenditure after Social Security.

[2] Chart provided by BofA.

A Teachable Moment

The Liz Truss comparison, while instructive, reveals more about structural differences than similarities. Truss’s downfall came from unfunded tax cuts that sent gilt yields soaring 150 basis points in days, forcing pension fund liquidations and mortgage market disruptions. Britain’s vulnerabilities—current account deficits, pension system architecture, and smaller capital markets—created susceptibility to sudden capital flight that doesn’t characterize the United States.

America operates with reserve currency status, deeper capital markets, and different institutional frameworks. When Federal Reserve Governor Christopher Waller observes that market participants are examining the fiscal legislation with concern, he’s describing normal market functioning rather than crisis dynamics. The bond market’s ability to price fiscal risk represents proper price discovery, not dysfunction.

The “reverse TARP moment” concept, where markets pressure Congress away from fiscal expansion rather than government rescuing markets, captures an interesting dynamic but likely overstates current conditions. In 2008, TARP represented extraordinary government intervention to stabilize frozen markets. Today’s environment reflects markets performing their traditional role of pricing risk into longer-duration securities while shorter-term instruments remain well-anchored.

If anything, you could make a credible claim that since the election, we’ve seen stagflation concerns expressed across the yield curve. But the twist steepened curve we have today since the election is a modest stagflation expression at best. Not something that should be ringing alarms quite yet.

This assessment doesn’t dismiss fiscal concerns. The Committee for a Responsible Federal Budget estimates the full tax package could reach $7.75 trillion above baseline over ten years. DOGE’s spending cuts, while politically significant, pale beside the revenue impact of extending and expanding tax reductions. These figures warrant serious consideration in any fiscal framework.

The endgame could unfold along several paths. Congress might blink first, scaling back tax cuts as yields approach 5.5% and mortgage rates follow suit. Alternatively, we could see a more dramatic Truss-style capitulation if pension funds or regional banks face liquidity stress. The third possibility—that America’s reserve currency status and deeper capital markets allow us to muddle through—seems increasingly optimistic.

History suggests that bond markets eventually win these confrontations. James Carville’s quip about wanting to be reincarnated as the bond market—”because you can intimidate everybody”—has aged remarkably well3. Whether Trump’s fiscal ambitions survive contact with 5% yields remains the defining question of 2025. The UK precedent suggests they won’t, but American exceptionalism has been known to defy gravity longer than physics would suggest possible.

The reckoning, when it comes, will be educational for all involved.

IMPORTANT LEGAL DISCLOSURES

CURRENT MARKET DATA IS AS OF 05/20/2025. OPINIONS AND PREDICTIONS ARE AS OF 05/20/2025 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.