In an economy a long time ago, in a country not far, far away at all… A period of economic depression.

The world economy is on the rocks as the early stages of economic depression begin to settle in. The League of Nations have met and declared it was time to put an end to the strain of tariffs on global trade. But as global leaders and representatives returned to their home countries, protectionist outcries steered decisions in the opposite direction. What ensued was pain and darkness nobody could have imagined. A lesson ultimately was learned that has not been repeated since. History may not repeat itself, but it often rhymes…

TARIFF ACT OF 1930

In 1929 Senator Reed Smoot of Utah and Representative Willis Hawley of Oregon penned legislation that proposed protectionist economic policies as the world entered a global depression. Smoot, in a sense, felt it was his duty to champion the United States’ mission to protect American jobs and farmers in the wake of the industrial revolution that followed the first World War.

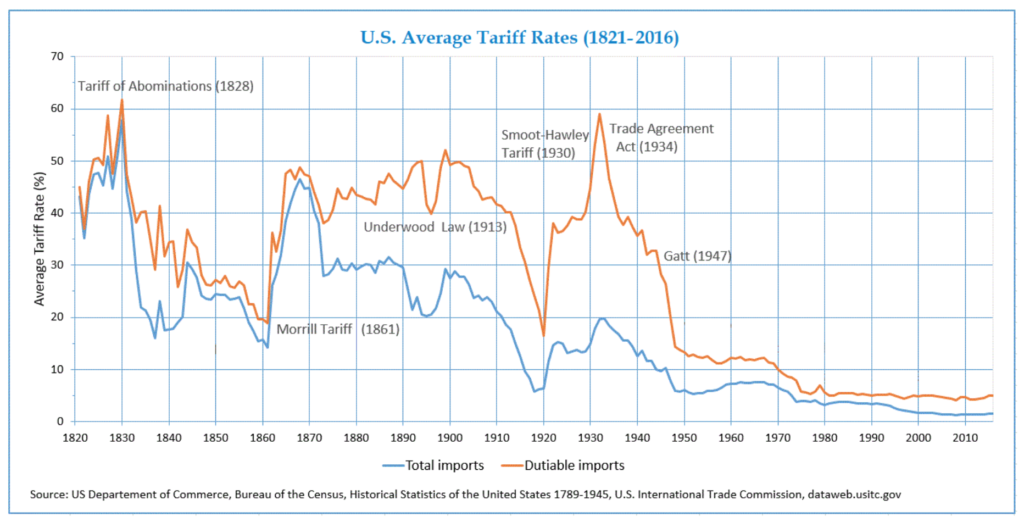

Tariffs were proposed by the then-majority GOP House and Senate which suggested tariffs to be placed on over 20,000 imported goods; it would be the largest in over 100 years. The proposal was an extension of the platform on which President Hoover was elected. President Hoover wouldn’t sign in the new law without a fight though. The private sector’s best and brightest visited 1600 Pennsylvania Ave in attempt to convince the President that signing in the law would be economic suicide. Then partner of J.P Morgan, Thomas Lamont, famously declared he was on the verge of dropping to his knees (literally) to beg President Hoover to side against the bill. Economist across the country, 1,028 of them to be exact1, even signed a petition that made it to the White House voicing their objection to the move. Ultimately the bill was signed by the President in 1930, even after the President publicly voiced his harsh criticisms against it (politicians will politic no matter the era).

MATCH, MEET KEROSENE

Why implement tariffs? Well, in theory they boost domestic business by incentivizing businesses and consumers to “shop local” to avoid being punished by taxation. The problem is, this only works in a scenario where a single country maintains a comparable and an absolute advantage for all of the goods their economy needs. That’s not how the world works (except for Wakanda).

The move by the U.S. sparked a wave of nationalism across the globe, the exact opposite of how this tale started. Tariffs were met with tariffs and the losers in the equation were consumers on every level. By 1933, U.S. imports dropped off by 66% while exports decreased by 61%. Gross national product (GNP) fell off a cliff. By 1931, GNP was measured at $75.8B down from $103.1B in 1929. But rock bottom wasn’t found until 1933 when it hit $55.6B. On a global scale, world trade declined by 66% in five years before the Trade Agreement Act in 1934 was passed by President Roosevelt and the newly minted Democratic Congress2.

What started out as a bill to help protect the U.S. Agriculture industry turned into the match that the barrel of kerosene, the global economy, didn’t need. Far from the crux of the Depression itself, but the bill certainly played its part in exacerbating the economic fragility.

FOOL ME ONCE, SHAME ON YOU…

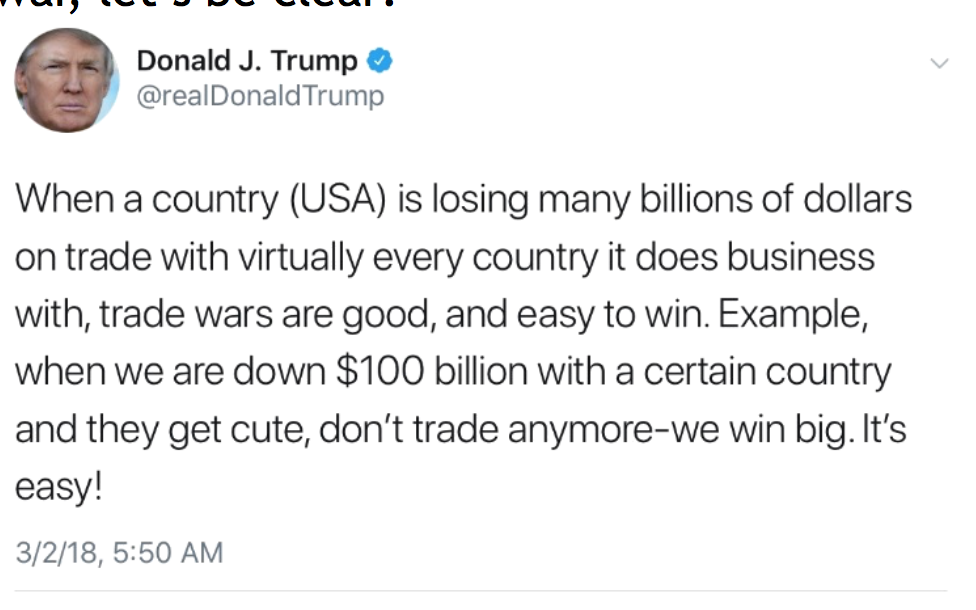

Fast forward 90ish years and there seems to be a similar stanza being drafted. A tweet is on the verge of launching 1,000 tariffs, but nobody should confuse Donald Trump with Homer. Recent demands for tariffs from the White House have been met with very little support from his closest confidants and world leaders. The proposal of a 25% tariff on steel and aluminum would directly impact the price of goods ranging from refrigerators to soda pop. The word tariff could (and should) be read as “tax hike” by any American consumer because that’s exactly what it translates to. This isn’t the first time tariffs have been brought up by the Trump Administration either.

You don’t need to go back to the Great Depression to see the impacts tariffs have on U.S. consumers. Lumber price increases of as much as 40% in the last 12 months have home builders warning buyers of increasing housing prices. The reason? Wildfires in California coupled with trade disputes with Canada and the U.S. last year resulting in 20% tariffs on lumber from Canada3. These higher home prices come as mortgage rates continue to climb to multi-year highs for those of you keeping score at home.

I’LL SEE YOU IN COURT

The world is not going to end because the U.S. wants to introduce a tax on steel imports. In fact, 75% of the steel utilized in the U.S. last year came from domestic manufacturers. The U.S. steel industry grew by 5% in the period as well4. What is spooking markets is the implications of this tariff actually being enforced and the apathy in the style for which it’s been declared.

Current rules of the World Trade Organization (WTO) state tariffs may not be introduced unless they are done in the name of national safety. This means countries impacted by the U.S.’ intended tariffs may take legal action within the courts of the WTO. Or, they may respond in a quicker, more direct way, with retaliatory tariffs. Hence the term trade war. Despite the tweets being sent from the Oval, there is no winner in a trade war, let’s be clear:

The rest of the world has plenty of leverage and firepower to respond to the U.S. More importantly, the EU and China each have the ability to negatively impact the U.S. in a big way. Coming into the year, global synchronized growth was the tune everybody was whistling down Wall Street. If the two largest economies in the world find themselves in a trade war before the first 90 days of the year, that narrative will come to an abrupt end.

The residual impact of a trade war would directly impact U.S. consumers and the economy as a whole at a time when volatility of economic data stands to disrupt this aging expansion. Inflationary pressures have been the focal point of most economic conversations in the first two months of the year and will only pick up more steam if consumer prices begin to rise due to tariffs.

Mix in the threat to domestic jobs being put on the chopping block due to rising input prices for downstream companies, and all of a sudden, the strength of the labor market begins to fade. These are the true concerns investors, U.S. officials and trading partners are expressing. We don’t think Jaime Dimon will find himself on his knees pleading with the President to reconsider. Quite frankly that’s not his personality. But it seems like the visceral response we saw 90 years ago is playing out at hyper speed. Let’s hope the rhyme ends there, and this war is one of words.

SOURCE: This presentation is solely for informational purposes and should not be taken as investment advice. For further information, please contact one of our investment adviser representatives. Graph provided by US Department of Commerce. 1 Economist. 2 Bureau of the Census, Historical Statistics. 3 Wall Street Journal. 4 Bloomberg.