In our last communication to investors on the state of the banking crisis, we raised a few questions. The most pertinent questions being, are we done with the bank run phase? And what does the next stage of this banking crisis look like? Jaimie Dimon recently declared[1] the first stage was finished- although he didn’t specifically state what that phase was. Context clues would tell us that the first iteration was capital flight risk leading to the fall in equity prices for banks. Observing some of the market dynamics we’ve seen play out with regional bank equities in the last week, we might have confirmation of what the second phase might entail. The good news, it might be mostly hot air. The bad news, it isn’t guaranteed to be non-consequential.

Short Sided

This week we saw a handful of regional banks come under pressure as the next names to enter receivership due to solvency issues. This core risk remains the same from what we saw in March; however, now we’re seeing divergence from the fundamentals within some of these banks and the price action of their equity.

Two names in particular that we can explore further are PacWest (“PACW”) and Western Alliance (“WAL”). Deposit flight isn’t apparent within either of these banks, despite the pressures we’ve seen across the industry. What’s convincing investors that these banks may be about to exit stage left is the downward pressure on their stock prices from short sellers:

[1] Comments made by Dimon following the purchase of First Republic, per CNBC May 1, 2023

[2] Chart provided by CBOE, as of May 4, 2023.

The bearish positioning on these two names isn’t unique to them. The entire regional banking index (as tracked by KRE) has seen the fourth highest volume behind the usual suspects of SPY, QQQ, and IWM.

The put option action we’ve seen across the space, and these two names specifically, have resulted in extreme downward pricing pressure on their equity in the last week, as options action has hit new highs. The regional banking index is down almost 10% in the last week, while PACW and WAL are off by 52% and 35%, respectively:

[3] Chart provided by Bloomberg database.

In the collapse of First Republic and Silicon Valley, they saw their stock prices decline as the reports across social media and traditional media began to circulate about deposits leaving the bank. But both WAL and PACW have come out in recent days providing data that has confirmed stable deposit figures.

Here is PACW on May 4th[4]:

“The bank has not experienced out-of-the-ordinary deposit flows following the sale of First Republic Bank and other news. Core customer deposits have increased since March 31, 2023, with total deposits totaling $28 billion as of May 2, 2023 with insured deposits totaling 75% vs. 71% at quarter end and 73% as of April 24, 2023. In addition, the company recently paid down $1 billion of borrowings with our excess liquidity. Our cash and available liquidity remains solid and exceeded our uninsured deposits, representing 188% as of May 2, 2023.”

And WAL on May 3rd[5]:

“The Bank has not experienced unusual deposit flows following the sale of First Republic Bank and other recent industry news. Total Deposits were $48.8 billion as of Tuesday, May 2, up from $48.2 billion as of Monday, May 1, and flat to Friday, April 28. Quarter to date, deposits are up $1.2 billion from $47.6 billion as of March 31. As of May 2, in accordance with regulatory requirements, insured deposits represent over 74% of total deposits, including reciprocal, collateralized, and accounts eligible for “pass-through” deposit insurance. Of our 20 largest deposit relationships, over 88% of these deposits are insured. Liquidity coverage of uninsured deposits from on-balance sheet liquidity and available borrowing capacity was approximately 165%.”

Flat and positive deposit growth in the days following FRC’s trip to the receivership farm upstate.

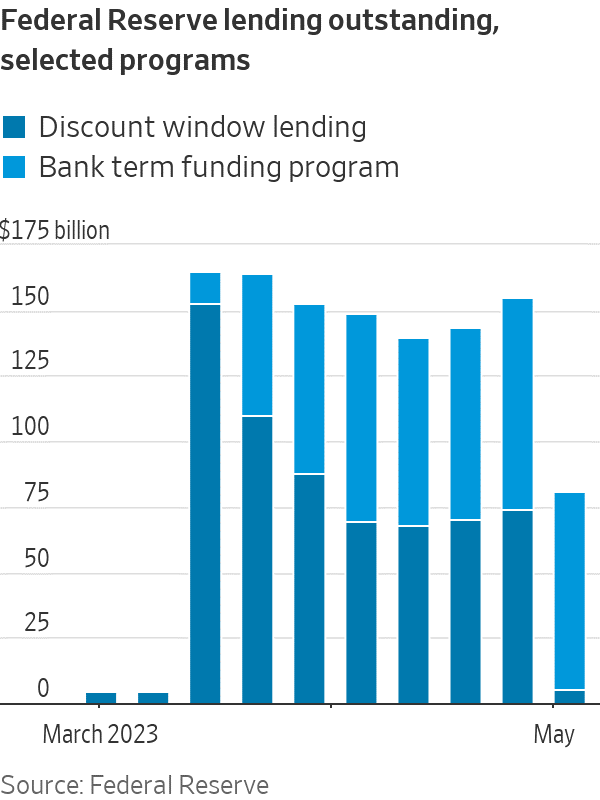

In fact, the data released by the Fed this week shows very little funding issues across the banking industry as a whole.

[4] Company filings

[5] Company filings

[6] Chart provided by Federal Reserve, as of May 4, 2023.

There was only $5.3 billion in discount window lending outstanding as of Wednesday, reflecting the acquisition of First Republic Bank by JPMorgan. Additionally weekly deposit data has shown that deposits have been stable across the smaller domestic charter banking institutions since the initial capital flight in March.

This data likely played a significant role in JP Morgan’s statement and sentiment following their FRC acquisition. Jamie Dimon noted [7] that he believes the three major banks that faced a fundamental issue in the initial weeks had now been removed from the system. He might be right, but this doesn’t mean no other banks can go under.

As we (keep calm and) carry on into the later spring and summer, investors (and consumers) will be wise to keep this deposit data in mind- despite what they might be witnessing within the stock prices of these banks. Additionally, those who might try to claim the Net Interest Income Margin risk for these banks is elevated, need to keep in mind that long-dated bonds have rallied since the start of the year, which helps reduce the unrealized losses in held-to-maturity portfolios.

The banking industry might be the most prone to sentiment impacting fundamentals. Largely, because it’s a business model that’s built on confidence. While the first phase of the crisis saw stock prices fall after deposits fled, the second phase carries the risk of deposits fleeing after the stock prices collapse. Despite the role, or lack thereof, fundamentals have played in the collapse in stock price for some of these banks so far. Absent a plan to protect depositors and potentially increase limits for insurance, short-sided investors can implement an extreme amount of pressure on some of these bank stocks. In an inverse relationship to what we saw during the pandemic with GameStop (“GME”)[8], options markets can easily move stock prices of companies with smaller market capitalizations. Today, the market cap of some of these banks is smaller than GameStop at the beginning of the stonk movement triggered by Reddit[9], despite the role they play in the real world economy trouncing that of GameStop’s.

[7] Comments made by Dimon following the purchase of First republic, per CNBC May 1, 2023

[8] Beginning in 2021, the short squeeze executed by retail traders on GME saw the value of the company skyrocket from nearly bankrupt, to a market capitalization of more than $16B.

[9] Data provided by Bloomberg database, as of 5/5/2023.

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 5/4/2023. OPINIONS AND PREDICTIONS ARE AS OF 5/4/2023 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. DISCUSSION OF SPECIFIC PUBLICLY TRADED STOCKS IS ONLY INCLUDED FOR ILLUSTRATIVE PURPOSES ONLY AND NOT A RECOMMENDATION. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. THE S&P 500 INDEX IS AN UNMANAGED INDEX, WHICH IS WIDELY REGARDED AS THE STANDARD FOR MEASURING THE U.S. STOCK MARKET PERFORMANCE. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.