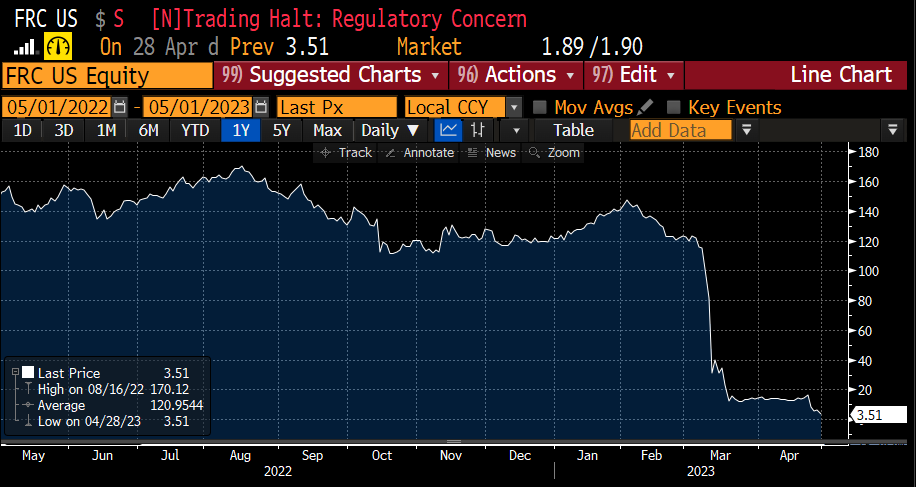

[1] Chart provided by Bloomberg database

Roughly 15% of First Republic’s revenues stem from their wealth management business unit- which was constructed of about 200 financial advisors and $270B in assets [2]. Most of these assets aren’t likely held at the bank itself. As is the case with most of the wealth management industry, they were likely held at a custodian like BNY Pershing, or Fidelity.

But that’s not a saving grace. If you’re a wealth advisor, you can’t hang your hat at a notoriously insolvent bank. Regardless of where your client’s assets are parked.

When stories began to circulate of large advisor teams fleeing the bank, the writing was on the wall for the bank as a whole.

The wealth management industry has been dominated by large, and even mid-sized, banks for decades. FRC was the 14th largest bank in the country [3]. Bigger than SVB. The pitch that has been sold by these banks to their clients has been “we are your personal bank, we can underwrite your mortgage, we can help with your business’ loan, we can lend you a personal line of margin, we can manage your assets- all under our roof.”

In a perfect world, and to the majority of people who are seeking financial guidance that don’t swim in the financial services industry all day long, this pitch makes perfect sense. One big, clean, turnkey solution.

But we live in reality, not a perfect world. So, when an adviser has sold a vision to their clients that “we can do it all”, they perceive you as responsible for all of it– even if you and your team were solely focused on their portfolio. You live and die by the letterhead.

The case for independent advisors has been strong long before the banking tremors of 2023. But the events over the last few months are real time case studies as to why everybody, but especially individuals and families with sizable assets, or large closely held businesses, should be seeking out or structuring their own independent advisory relationships. More than $110T have migrated to independent advisory and family office relationships in the last 20 years[4]. That number isn’t going to shrink anytime soon.

The vision of an all-encompassing wealth management relationship that was drawn up by the legacy names in this industry wasn’t completely flawed. But the one thing that was left out in the value proposition to prospective clients was objectivity.

[2] Data provided by company filings.

[3] Data provided by Bloomberg database.

[4] Financial Advisor Magazine, June 2021.

Mutation

Anytime you’ve had a bank failure, you’ve clearly had a failure in bank management. Both inside and outside the walls of the proverbial vault. From client profile concentration, deposit size concentration, liquidity risks, regulatory risk- the list goes on for the items a bank needs to be consistently on top of from a risk management perspective.

For the last month or so, we’ve been in a phase of this banking tremor where capital flight has been a significant culprit as to what’s set off the alarms. There’s no getting around it. If deposits at these banks had been stickier, then we wouldn’t be sitting in the ashes of three bank failures in a 5-week span, wondering what’s next.

A decade-plus of accommodative monetary policy has masked an entire underbelly of poor risk management by many of these institutions, and their customers. The word “idiosyncratic” or “contained” has been used to describe what’s transpired to this point. But I must ask the question, how many idiosyncratic events do you have to have before you’ve stumbled into something systemic?

Jaime Dimon confidently declared ‘this part of the crisis is over’ shortly after the news just broke that his bank had just purchased First Republic for pennies on the dollar. Some have taken this as a signal that we’re in the clear. I think that’s an optimistic take. I think he is referring to the next ripple that’s on the horizon.

During the pandemic, so many of us thought we’d beaten Covid-19. Just for a new variation to show up and repeat the cycle. The next mutation, or variant, of this banking fallout is likely to come in the form of the chronic mismanagement of risk that’s gone unnoticed. After a year of warp speed interest rate hikes, we were destined to see just what parts of the economy would show were the weak links. This started with the housing market coming to a halt last year, and now we’ve seen it metastasize into these regional banks. There’s no guarantee there won’t be additional rate hikes into this summer, and as the impact of the first 500bps of this cycle continued to impose its will on the economy; there could be more weaknesses out there that we haven’t recognized yet.

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 5/2/2023. OPINIONS AND PREDICTIONS ARE AS OF 5/2/2023 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. THE S&P 500 INDEX IS AN UNMANAGED INDEX, WHICH IS WIDELY REGARDED AS THE STANDARD FOR MEASURING THE U.S. STOCK MARKET PERFORMANCE. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.