As we step into 2025, the bond market has been a crucible of contradictions and surprises, testing narratives and challenging conventional wisdom. The 10-year yield, once perceived as anchored after the Fed’s initial rate cuts, has defied expectations, surging higher amidst a maelstrom of economic data, shifting narratives, and policy speculation. This dynamic has led many to reevaluate their positions, particularly those, like ourselves, who leaned into duration as the cycle seemed to peak in late 2022.

Navigating the Peaks and Valleys

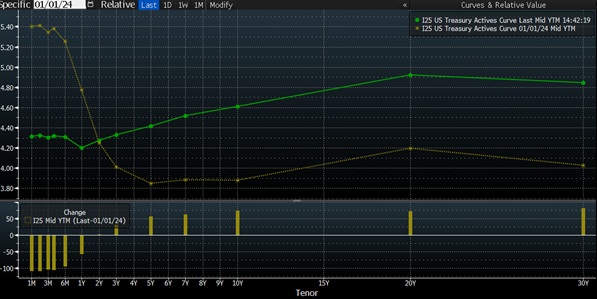

Our thesis in November 2023 was predicated on the 10-year yield reaching its cycle high at 5%. While that level has not been retested, the bond market’s trajectory since then has been anything but linear. Recent months have witnessed a sharp rebound in yields, fueled by a combination of strong job growth, rebounding inflation prints, and renewed growth optimism. However, beneath these surface-level shocks lies a more complex narrative of structural disinflationary forces, cooling labor markets, and policy recalibration.

[1] Chart provided by Bloomberg database.

The Fed’s journey from aggressive rate hikes to cuts has been accompanied by a narrative whiplash. Early 2024 saw discussions of seven potential rate cuts, only to pivot by mid-year to hawkish rhetoric as inflation fears reignited. As it stands, the Fed appears committed to its “sound hawkish, act dovish” strategy, maintaining a cautious approach while emphasizing data dependence. This has created a feedback loop in the markets, where every inflation print and jobs report is dissected for clues about the Fed’s next move.

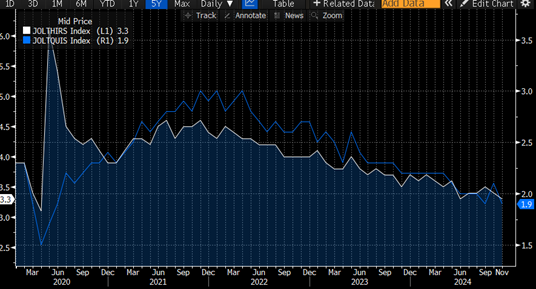

[2] Chart provided by Bloomberg database.

The Dynamics of Inflation and Labor

The January CPI report offered a microcosm of the current economic landscape. While core PCE—the Fed’s preferred inflation gauge—showed moderation, concerns linger around sticky components like rent inflation. Encouragingly, rent disinflation in key markets such as Texas and Florida continues to offset potential pressures from regions like California, where the aftermath of the LA fires may create localized upward pressures. Wage growth, a critical driver of inflation, remains on a downward trajectory, aligning with our view of a gradually cooling labor market.

[3] Chart provided by Bloomberg database.

[4] Chart provided by Bloomberg database.

It is worth noting that Powell’s focus on core services inflation ex-shelter underscores the Fed’s broader strategy. Recent data points, including a softer-than-expected CPI services print, suggest that inflationary pressures are not accelerating uncontrollably. This provides a measure of relief for our duration positioning, reinforcing our belief that the 10-year yield’s recent spike is overextended.

[5] Chart provided by Wall Street Journal.

A Market of Shifting Narratives

Markets have oscillated between growth euphoria and inflation panic. The MOVE index, a barometer of interest rate volatility, exemplifies this dynamic. After momentarily declining post-election, it has resumed an upward march alongside the 10-year yield, reflecting heightened uncertainty. Yet, we contend that the market may be over-discounting the risks of a prolonged inflationary surge and underappreciating the structural factors anchoring long-term rates.

[6] Chart provided by Bloomberg database.

Historically, high rates have served as their own antidote, curbing economic activity and ultimately leading to lower yields. The current environment is no exception. Credit-sensitive sectors like housing remain subdued, with activity levels far below pre-COVID peaks. This serves as a critical counterbalance to growth optimism fueled by strong labor market prints and fiscal policy speculation under the new administration.

Trump 2.0: Policy and Chaos

The political landscape adds another layer of complexity. The re-election of President Trump has reignited debates around fiscal and trade policies. While pro-growth narratives dominate headlines, the potential for disruption—from tariffs to mass deportations—cannot be ignored. Investors’ implicit assumption that extreme campaign promises will be tempered in implementation may prove overly optimistic.

Drawing parallels to Trump’s first term, we observe that initial market optimism often gave way to volatility as policy uncertainties materialized. From mid-December 2016 through August 2017, 10-year yields declined amid growing economic uncertainty. A similar pattern could emerge in 2025, as markets digest the implications of Trump’s agenda and its potential to disrupt existing economic dynamics.

Inflation: The Stubborn Storyline

Despite the Fed’s best efforts, inflation remains a central focus. The rebound in core goods inflation complicates the narrative, though it is largely anchored by external factors such as China’s weak economy and excess productive capacity. Services inflation, particularly rent and lodging, poses a more persistent challenge. However, signs of disinflation in shelter components suggest that some of these pressures may ease in the coming months.

Notably, the Fed’s proactive rate cuts in late 2024 achieved their intended goal of arresting perceived downward economic momentum, albeit at the cost of reigniting growth and inflation concerns. This reflects the delicate balance the Fed must strike as it seeks to navigate a strong labor market without exacerbating inflationary pressures.

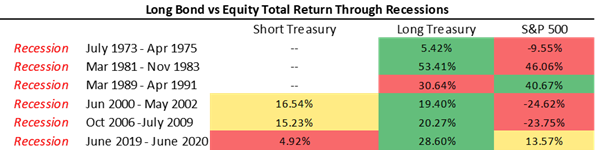

The Case for Long-Dated Treasuries as a Macro Hedge

In this environment, long-dated Treasuries offer a unique and compelling opportunity as both a hedge and a potential source of returns. Their historical role as a countercyclical asset remains intact, particularly in scenarios of unexpected economic weakening or a sudden shift in risk sentiment. The recent surge in yields has enhanced their appeal, creating an asymmetric reward-to-risk profile for investors who can weather short-term volatility.

[7] Data provided by Bloomberg database.

The “cure for high rates is high rates”—a dynamic where elevated borrowing costs naturally temper economic activity—suggests that current yield levels may not be sustainable. Should growth optimism fade or geopolitical uncertainties escalate, Treasuries could provide a ballast to portfolios, offsetting potential equity market drawdowns. Furthermore, the expanding term premium reflects an overreaction to near-term inflation fears, presenting an attractive entry point for duration exposure.

For those with the flexibility to incorporate macro instruments, long-dated Treasuries represent a strategic hedge against downside risks. They offer protection in a “gray swan” event—a less likely but impactful economic downturn—while also benefiting from any policy missteps or abrupt shifts in market sentiment. In our view, these instruments are not just a defensive play but a proactive positioning for a more balanced risk environment.

Positioning for the Road Ahead

In this environment, we maintain our conviction in the structural factors supporting lower yields. While the recent move higher in the 10-year yield has been painful, it presents opportunities for those willing to look through the noise. Macro instruments offer compelling hedging opportunities for equity portfolios, particularly as the risk of an economic slowdown—or a “gray swan” event—looms large.

We caution against over-interpreting near-term data and advocate for a disciplined approach. The labor market’s cooling trend, the Fed’s dovish undertones, and the broader disinflationary backdrop provide a foundation for long-duration assets to recover. Additionally, the term premium, which has expanded significantly, is likely to recede as growth euphoria moderates and economic realities set in.

Final Thoughts

As we look to the rest of 2025, we remain vigilant but optimistic. The bond market’s volatility underscores the importance of staying grounded in fundamentals while being nimble in navigating shifting narratives. Our focus remains on identifying opportunities that align with our long-term investment philosophy, balancing risk and reward in a complex macro environment.

IMPORTANT LEGAL DISCLOSURES

CURRENT MARKET DATA IS AS OF 01/17/2025. OPINIONS AND PREDICTIONS ARE AS OF 01/17/2025 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.