It’s tempting to think that US stocks are struggling with earnings, but that’s not quite right. The real issue here is expectations. Markets are brimming with optimism—banking on 3% real GDP growth in the second half of 2024, a 16% year-over-year surge in earnings by the end of 2025, and an AI-driven future that somehow justifies 21x earnings multiples. These sky-high expectations set the stage for disappointment. And when expectations are this lofty, there’s not much room for error.

U.S. Stocks: Not An Earnings Problem, But An Expectations Problem

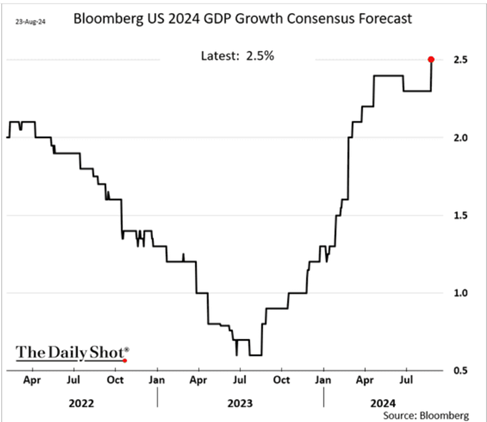

Let’s start with the short term. Growth expectations for the US economy remain strong, perhaps a little too strong. If you’re aiming for 2.5% growth for the year and already recorded around 2% in the first two quarters, you’ll need nearly 3% growth in the second half of 2024. That’s pretty ambitious. When the market is pricing in that kind of growth as the baseline, it doesn’t leave much cushion for any surprises.

[1] Bloomberg database.

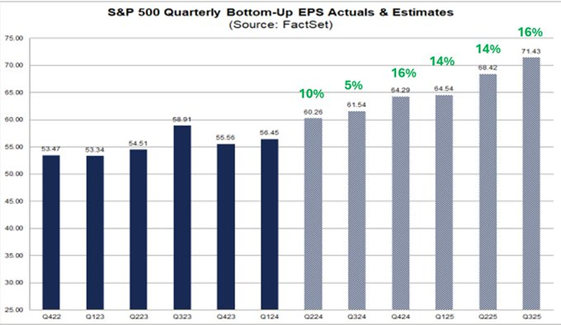

Then we move to the medium term, where earnings expectations are equally elevated. This quarter brought the first meaningful positive earnings growth in a while, which is great. But the forecast calls for a brief lull next quarter, followed by rapid earnings growth through the end of 2025.

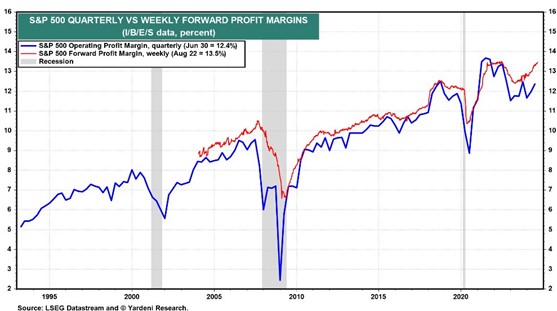

With revenue growth projected at around 5-6%—not far off from current nominal GDP—achieving over 15% earnings growth means a big surge in profit margins, pushing them to new secular highs. Again, not impossible, but far from easy.

[2] Chart provided by FactSet.

[3] Chart provided by Yardeni Research.

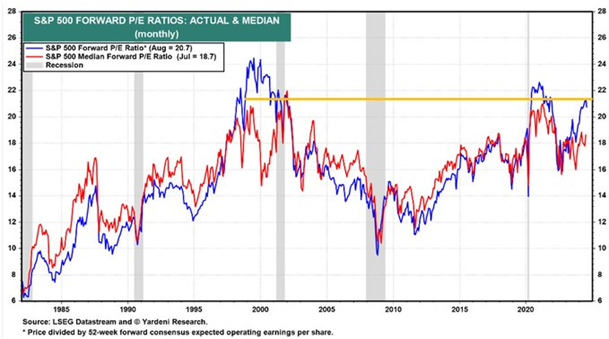

And then there’s the long-term view. Price-to-earnings (PE) ratios are hovering just below all-time highs. Why? The story goes that AI will revolutionize everything, creating a new era of productivity growth and investment. The AI believers argue this is enough to justify those elevated valuations. But even if we buy the premise of an AI boom, the math doesn’t quite work out. To get to the double-digit earnings growth rates the techno-optimists are touting for the next decade, you’d need more than just a productivity surge; you’d need profit margins to expand at a rate far beyond anything we’ve ever seen.

[4] Chart provided by Yardeni Research.

And therein lies the rub. Margin expansion doesn’t happen in a vacuum—somebody, usually workers, ends up on the losing side. The idea that corporate margins could expand so dramatically without a major economic shift elsewhere is more than a little optimistic. It would require a massive change in how much another sector is saving or dissaving, and that’s no small feat.

What we’re seeing now reflects this tension. Since March 2023, when AI mania took hold, the S&P 500 has jumped 40%[5]. That suggests a lot of the AI boom is already priced into the market. When expectations are this inflated, even slight disappointments can lead to sharp corrections. This last earnings season has already shown us that dynamic, with several AI leaders posting weak stock performances, not necessarily because their earnings were bad, but because they didn’t quite live up to the hype—or because there are longer-term concerns about profitability.

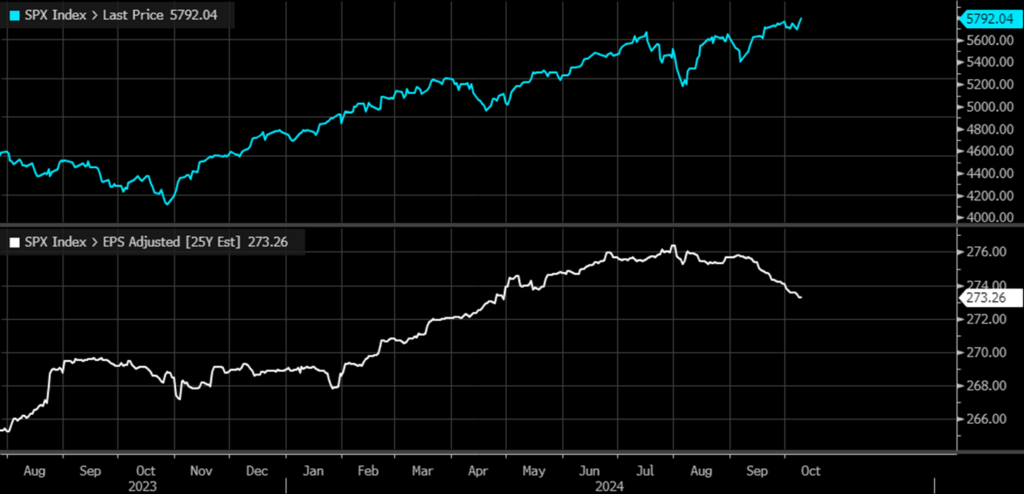

As we have moved closer to this month’s on slot of earnings reports, analysts have begun to dial back their expectations for what 2025 guidance might look like. Expectations at the beginning of October are at their lowest level since April, when the S&P 500 was trading at about 5,100 (vs the 5800 today):

[5] Data provided by Bloomberg database.

[6] Chart provided by Bloomberg database.

Market returns hinge not just on economic fundamentals but on how those fundamentals measure up against what’s already priced in. Buying stocks now means betting that conditions will turn out even better than the already optimistic projections. When markets are banking on solid short-term growth, robust medium-term earnings, and a game-changing AI boom in the long term, it’s not hard to imagine a few scenarios where things don’t go according to plan.

In essence, being long on stocks today isn’t merely a call for a soft landing; it’s a wager on a near-perfect growth story from here on out. And with expectations set this high, a little dose of skepticism might be the safest bet of all.

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 9/5/2024. OPINIONS AND PREDICTIONS ARE AS OF 9/5/2024 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.