The financial world is buzzing with anticipation as global liquidity surges to record levels, and the Fed hints at a potential shift in policy. As markets react to every word from Jerome Powell, investors are left to ponder whether we’re entering a new phase of economic recovery or bracing for the next big challenge. With interest rate cuts possibly on the horizon and the stock market showing signs of broader participation, the stakes have never been higher. In this blog, we’ll unpack these developments, exploring their potential impact on your investments and the future of the economy. Let’s dive into what might be the beginning of a pivotal moment in financial history.

That’s That Monetary Espresso

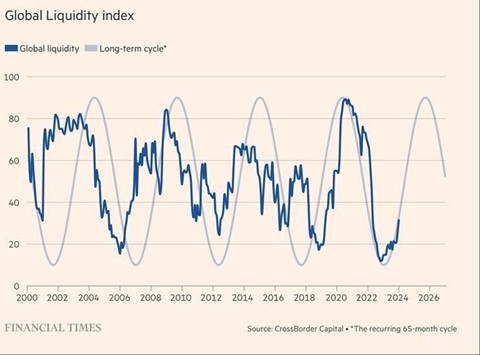

Global liquidity is on the rise, climbing $1.1 trillion last week to reach a record $174.7 trillion. That’s trillion with a “T.” This surge of capital into the global financial system is like a shot of espresso for markets—extra energy, a bit of a buzz, and a noticeable drop in desperation as liquidity flows freely. More capital sloshing around means easier access to money, which is usually a good thing if you’re in the business of making money, and who isn’t? But don’t send your discretion on vacation just yet.

[1] Chart provided by Financial Times

So, what does this mean for your portfolio? In short, global markets might get a bit of a tailwind. Stocks, particularly those in sectors that thrive when economies are growing, could see a nice boost. That’s good news for the U.S. and global economies because, historically, more liquidity tends to fuel growth and bolster investor confidence. But—and there’s always a “but”—there’s also the nagging worry that too much of a good thing could inflate asset bubbles or destabilize financial markets.

The Time Has Come

Now, let’s talk about the elephant in the room: interest rates. The Fed is expected to cut rates in about a month, and while it’s likely to be a modest 25 basis points[2] —a mere drop in the bucket compared to the tidal wave of rate hikes over the last two years—it’s the message that matters. Wall Street’s buzzing about this because it signals the Fed is likely done fighting inflation. Remember those days when mortgage rates were at a comfy 3%? We might not see that again, but the current ~7% scorcher could start to cool off, making it easier for businesses to make strategic decisions without feeling like they’re running a marathon in quicksand.

Jerome Powell, speaking at the Kansas City Fed’s economic symposium in Jackson Hole, provided more clues. He acknowledged the rise in the unemployment rate to 4.3% in July, stating, “We do not seek or welcome further cooling in labor market conditions.” Translation: The Fed’s getting nervous about pushing too hard. Then he dropped the line that has every Fed watcher on high alert: “The time has come for policy to adjust. The direction of travel is clear.”

In Fed-speak, this is practically a flashing neon sign saying, “Rate cuts coming soon!” Some are even speculating that the Fed might not stop at just one 25 basis point cut—they might go for 50[3], especially if they’re serious about nudging the Funds rate closer to a level that’s less restrictive in today’s economic climate.

This potential shift comes as companies face emerging headwinds from cooling economic activity, which has started to slow sales growth. While a few rate cuts won’t flip monetary policy from tight to loose overnight, they would make it less suffocating. For an economy that’s still relatively healthy, this could be just the tonic it needs to avoid slipping into something worse.

And, of course, a brighter economic outlook would be good news for sales and even better news for earnings, which, as we never tire of saying, are the ultimate driver of stock prices in the long run.

We got a sneak peek of this potential new financial era in the stock market last week. After Thursday’s inflation report, 80% of S&P 500 members were up[4] —happy days if you’re diversified. Small-cap stocks, which have been especially battered by higher rates, had their best day in eight months. Sure, the S&P 500 itself didn’t join the party, but that’s because money was shuffling around, not fleeing. Investors were selling off tech darlings and pouring into real estate trusts and utility companies, which is a good sign that this rally is getting broader and more balanced.

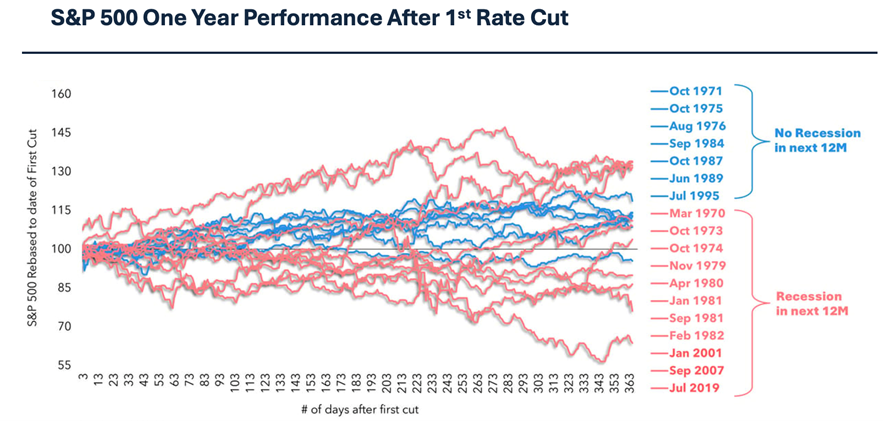

But before we break out the champagne, let’s be real: things can go south. Fast. Rate cuts, historically, are a mixed bag. The last few times the Fed slashed rates, it was in response to crises—think COVID, the 2008 financial meltdown—and stocks tanked further before finding their footing. There’s also the risk that the Fed could overdo it. A rate cut might spark a frenzy, with markets getting ahead of themselves, possibly leading us back to the meme stock mania of 2021. And you remember how that ended, right? Not with a bang, but with a Reddit-fueled whimper.

So, here we are, staring down the barrel of a rate cut with all the excitement and dread that comes with it. The U.S. economy doesn’t look like it’s teetering on the edge of a recession right now—people are employed, they’re spending money, and the skies aren’t filled with ominous clouds (yet). If history is any guide, the stock market could continue to climb, but probably in a slow, grinding sort of way, not the rocket-fueled ride we saw in the low-rate days.

[2] Current market probabilities imply a 25 basis point cut in September (64% chance) according to CME Group FedWatch as of 8/27/2024.

[3] Current market probabilities imply a 50 basis point cut in September (34% chance) according to CME Group FedWatch as of 8/27/2024.

[4] Data provided by Bloomberg database.

[5] Chart provided by The Compound, data provided by Standard & Poor’s.

[6] Data provided by Bloomberg database.

[7] Data provided by Bloomberg database.

The average return 12 months after the first rate cut without a recession has been 11% on average. While the average return 12 months following the first rate cut and a recession materializes has been 8%. In fact, in 60% of periods where a recession manifested, equity returns were still positive 12 months following the first cut[6].

The average drawdown of 11% within 12 months of the first rate cut is only slightly higher than drawdowns averaging 9% over ALL 12-month periods. Taking out the recessionary periods, the average drawdown of 4% within 12 months of a rate cut is literally as benign as it gets[7].

Here’s the bottom line: rate cuts don’t always lead to financial irresponsibility, and they don’t always end in tears. But it’s essential to stay grounded. Prepare for lower rates, but don’t get too carried away with dreams of easy money and soaring stocks. Keep an eye on the fundamentals, and don’t let the noise distract you from your long-term strategy.

In the end, the market is a complex, often irrational beast. We can’t predict every twist and turn, but we can be smart about how we navigate it. So, let’s welcome the coming changes with cautious optimism and a healthy dose of skepticism. After all, in finance, as in life, it’s always good to expect the unexpected.

LEGAL STUFF

CURRENT MARKET DATA IS AS OF 8/27/2024. OPINIONS AND PREDICTIONS ARE AS OF 8/27/2024 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.