The biggest challenges in risk management often come from bi-modal events—situations where outcomes are vastly different, each carrying significant uncertainty. In these scenarios, hedging becomes a guessing game, and the 2024 U.S. election is shaping up to be just that.

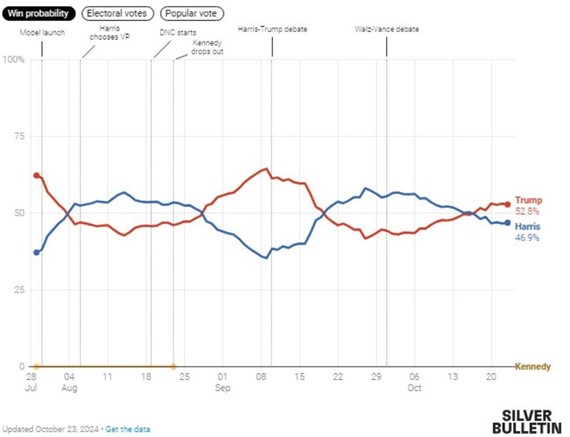

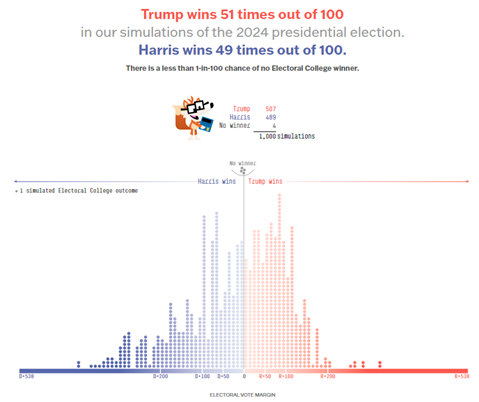

Both the presidential race and the Senate balance are neck-and-neck:

[1] Chart provide by FiftyThirtyEight.

[2] Chart provided by FiftyThirtyEight

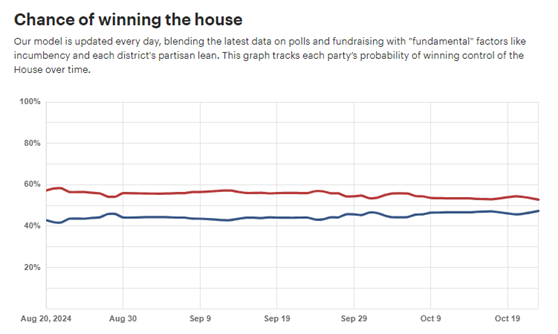

The Senate, often seen as leaning Republican, still shows enough uncertainty to be effectively a coin toss for risk managers:

[3] Chart provided by FiveThirtyEight.

This political fog mirrors what we’ve seen before: a landscape filled with unknowns, with very few ways to map out a clear investment playbook.

The problem isn’t just the outcome, but the ripple effects on markets. We can speculate on policy differences between a Democratic sweep versus a Republican one, but history tells us that even if we correctly predict the political result, translating that into market movements is a different beast. Look back at 2016—the markets oscillated wildly overnight, reacting to each piece of news before rallying sharply when Trump’s victory was confirmed. Days earlier, markets priced in a negative beta, only to surge when the opposite materialized.

[4] Chart provided by FactSet.

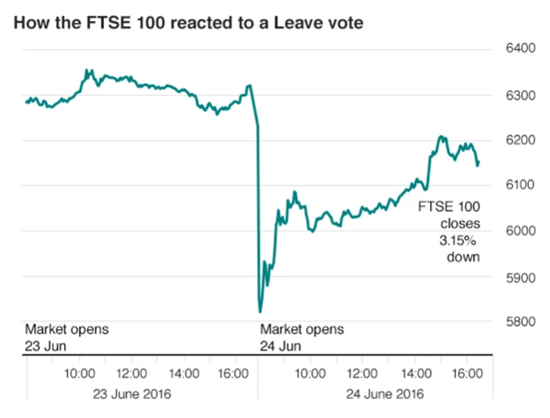

And it wasn’t just equities. A diversified global asset book, even one running moderate volatility, could see 5% swings within hours. Brexit, another example, had markets teetering on polling results before the vote and was followed by a wave of volatility. Yet, despite all the chaos, the FTSE 100 ended the week higher after calming words from the Bank of England.

[5] Chart provided by New York Times

These past events underscore that periods of high uncertainty and binary outcomes create substantial market volatility, but not necessarily directional clarity. From a risk management standpoint, this should be a moment of control, not a chance to seek alpha.

The Folly of Political Speculation

Betting on market outcomes from elections is essentially a two-part wager. First, a manager must believe they have a better read on the election outcome than experts who also view it as a toss-up. Second, they need to predict how that outcome will manifest across the markets—an almost impossible feat.

Think about it: Most managers specialize in analyzing companies, economic trends, and industry linkages. Even then, generating consistent alpha is a challenge. So why would anyone believe they have an edge in predicting a political event that occurs once every four years, and is mostly outside their domain?

Sure, someone might get lucky and make the right call, but that’s the key—luck, not skill. And if they do believe they have some special insight, the sample size is so small that it’s impossible to verify any genuine edge. Plus, even if you correctly forecast the political outcome, pricing in market reactions adds a layer of complexity that can easily derail a strategy.

History has shown us that the market response to political events is often unpredictable. Even if you knew the election results ahead of time, the market trajectory could still surprise you. The best asset managers thrive on repeatable, time-tested strategies—making election bets is the antithesis of that.

When Speculation Signals a Problem

For allocators, election season is a stress test. If a manager is making speculative bets based on political outcomes, it’s a red flag. They are unlikely to have a real edge on predicting elections, let alone the secondary effects on markets. More importantly, this behavior suggests a lapse in discipline, potentially creeping into other parts of their investment process.

A prudent asset manager trims risk and avoids making directional bets on high-stakes, high-uncertainty events like elections. They stick to their game plan, focusing on what they do best—picking investments that can outperform over the long term. For allocators, this is an opportunity to identify who is staying true to their mandate and who might need to be shown the door.

IMPORTANT LEGAL DISCLOSURES

CURRENT MARKET DATA IS AS OF 10/23/2024. OPINIONS AND PREDICTIONS ARE AS OF 10/23/2024 AND ARE SUBJECT TO CHANGE AT ANY TIME BASED ON MARKET AND OTHER CONDITIONS. NO PREDICTIONS OR FORECASTS CAN BE GUARANTEED. INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED.

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY CLIENTS AND PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISER. DO NOT USE THE FOREGOING AS THE SOLE BASIS OF INVESTMENT DECISIONS. ALL SOURCES DEEMED RELIABLE HOWEVER GFG CAPITAL ASSUMES NO RESPONSIBILITY FOR ANY INACCURACIES. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THIS MATERIAL DOES NOT CONSTITUTE A RECOMMENDATION TO BUY OR SELL ANY SPECIFIC SECURITY, PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. INVESTING INVOLVES RISK, INCLUDING THE POSSIBLE LOSS OF A PRINCIPAL INVESTMENT.

INDEX PERFORMANCE IS PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY. DIRECT INVESTMENT CANNOT BE MADE INTO AN INDEX. INVESTMENT IN EQUITIES INVOLVES MORE RISK THAN OTHER SECURITIES AND MAY HAVE THE POTENTIAL FOR HIGHER RETURNS AND GREATER LOSSES. BONDS HAVE INTEREST RATE RISK AND CREDIT RISK. AS INTEREST RATES RISE, EXISTING BOND PRICES FALL AND CAN CAUSE THE VALUE OF AN INVESTMENT TO DECLINE. CHANGES IN INTEREST RATES GENERALLY HAVE A GREATER EFFECT ON BONDS WITH LONGER MATURITIES THAN ON THOSE WITH SHORTER MATURITIES. CREDIT RISK REFERES TO THE POSSIBLITY THAT THE ISSUER OF THE BOND WILL NOT BE ABLE TO MAKE PRINCIPAL AND/OR INTEREST PAYMENTS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.