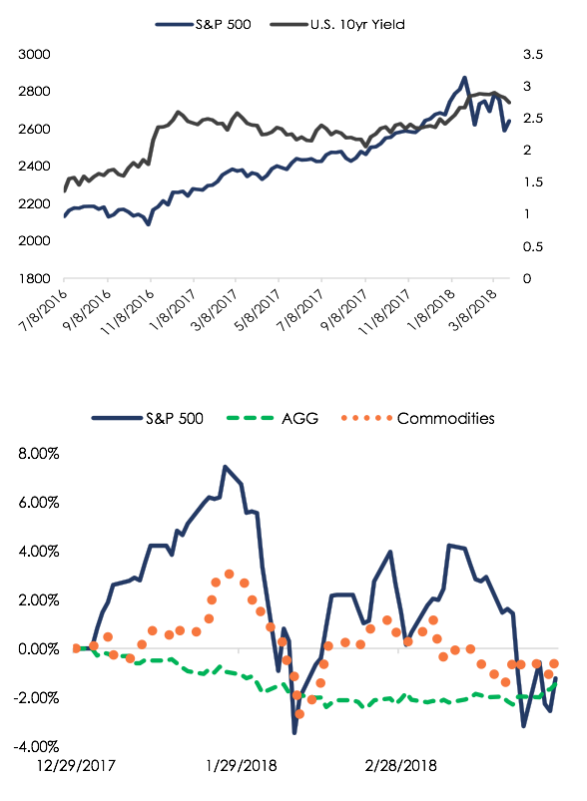

After the first three months of trading in 2018, investors have been swiftly and not so politely reminded of one of the fundamental characteristics of markets. Perhaps no better forecast has been made than by Mr. J.P. Morgan when asked what he thought equities would do a little more than a century ago. After a year without virtually any disturbance, global markets had trouble finding their footing in the first quarter of 2018. No asset class appeared to be immune from the turbulence as the first quarter was the first three-month period since 2008 where the S&P 500 and the Barclay’s US Aggregate Bond Index posted negative returns. In the last 30 years, this occurrence has only transpired in eight quarters. In just three of those eight quarters, commodities posted a negative return1. The first quarter of 2018 joined the club as the Bloomberg Commodities Index posted a negative return as well. While the wide spread volatility seems to be checking a lot of boxes that would categorize it as unique, or an outlier, this reversion to mean of sorts is what we think investors should be prepped for. A message we believed needed to be made abundantly clear coming into the year, we haven’t been taken off guard. While many will rush to attribute these gyrations to a single cause, or tweet, we don’t think there is a clear culprit other than: it was time. There was no shortage of noise during the quarter, with a couple market drivers that carry implications to make a tangible impact. With “Goldilocks” being the theme for so many coming into the year, it appears that the first quarter was when the three bears made it back home.

After the first three months of trading in 2018, investors have been swiftly and not so politely reminded of one of the fundamental characteristics of markets. Perhaps no better forecast has been made than by Mr. J.P. Morgan when asked what he thought equities would do a little more than a century ago. After a year without virtually any disturbance, global markets had trouble finding their footing in the first quarter of 2018. No asset class appeared to be immune from the turbulence as the first quarter was the first three-month period since 2008 where the S&P 500 and the Barclay’s US Aggregate Bond Index posted negative returns. In the last 30 years, this occurrence has only transpired in eight quarters. In just three of those eight quarters, commodities posted a negative return1. The first quarter of 2018 joined the club as the Bloomberg Commodities Index posted a negative return as well. While the wide spread volatility seems to be checking a lot of boxes that would categorize it as unique, or an outlier, this reversion to mean of sorts is what we think investors should be prepped for. A message we believed needed to be made abundantly clear coming into the year, we haven’t been taken off guard. While many will rush to attribute these gyrations to a single cause, or tweet, we don’t think there is a clear culprit other than: it was time. There was no shortage of noise during the quarter, with a couple market drivers that carry implications to make a tangible impact. With “Goldilocks” being the theme for so many coming into the year, it appears that the first quarter was when the three bears made it back home.

Recent Market Drivers

Economic Growth

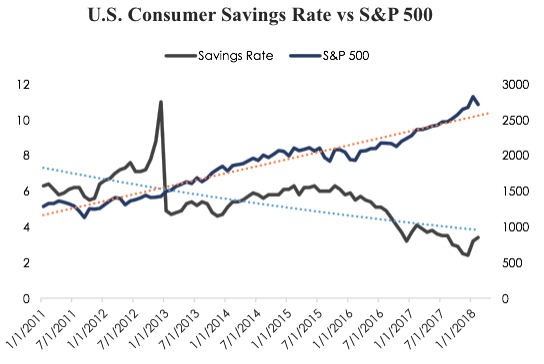

The start of 2018 was being pegged as an optimal growth environment for the global economy. This led to the title of Goldilocks being passed around quite liberally. Every corner of the globe was experiencing growth, with rising expectations. Everything was just right. Even some unforeseen side effects have been even more pro-risk asset than anticipated. So, what gives? Not the consumer. A lot of the U.S. growth outlook is driven by the core of the U.S. economy: the consumer. Consumer spending accounts for 70% of GDP. Without the propensity to spend, nothing will be put into motion. In the first quarter, we saw consumer savings increase in the first two months, with expectations for the final reading of the quarter to now signal the same trend.

Fiscal policy to this point has been aimed at increasing the amount of dollars circulated within the economy. While monetary policy with the same objective entails printing new money, fiscal policy is urging spending. Both on a corporate level and consumer level. But without an uptick in spending from consumers (i.e. a decline in the savings rate), corporations will have little incentive to deploy their newfound capital toward Capex, R&D or hiring. Instead, they’ll likely resort to returning cash to shareholders.

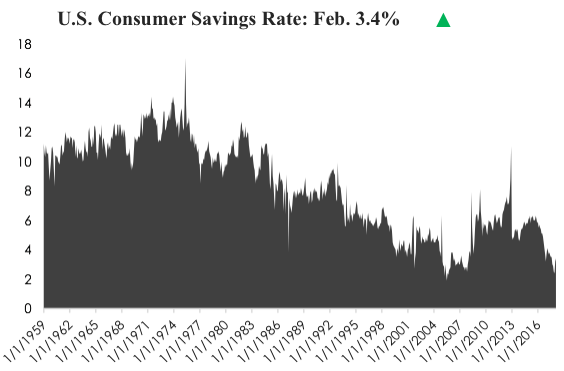

The savings rate has been in a steady decline since its peak in the ’70s (top). But not all of this spending has been of the discretionary variety. In the last six months, we’ve seen spending increase by 30% on food and energy items. This clip is an 11% increase over the last two years2.

We don’t see the global growth projection being put at risk just yet. But this is something that carries more significant implications than the initial blip on the screen. Are consumers unimpressed with the global growth story? Are they preparing for what comes after the growth trend plays out? Surely, Goldilocks didn’t conduct her B&E (breaking and entering) and lived happily ever after. No, the bears came home, and she ran screaming for help never to be seen again.

Bond Yields

Bond yields have been on the move in 2018 disrupting asset classes across the globe, and some investors have been left puzzled. Not only do we view this as a net positive for bond investors in the long run, we think this creates the opportunity for asset allocations to migrate closer toward intended risk profiles. With higher bond yields, equities have a higher hurdle to clear from a return perspective to be a viable alternative. This is called equity risk premium.

Bonds, and bond investors, have had seemingly no trouble generating a return over the last 30+ years. A bull market in bonds has been running at what seems like at an unstoppable rate. Naturally, there’s been no complaints from owners of these assets. But we’re seeing bond yields begin to move in a direction that is relatively foreign for many, which triggers a divergence in trend in price. This has left many investors to ask questions of how a change in environment will impact their fixed income positions. Have the good times come to an end? Not necessarily. We think things are setting up for a better picture down the road.

Bonds, and bond investors, have had seemingly no trouble generating a return over the last 30+ years. A bull market in bonds has been running at what seems like at an unstoppable rate. Naturally, there’s been no complaints from owners of these assets. But we’re seeing bond yields begin to move in a direction that is relatively foreign for many, which triggers a divergence in trend in price. This has left many investors to ask questions of how a change in environment will impact their fixed income positions. Have the good times come to an end? Not necessarily. We think things are setting up for a better picture down the road.

Many investors might be thinking the fun is over in bonds and they shouldn’t be used in their allocations if we’re looking at a period of rising rates. An important point that needs to be understood by all investors is that without yield, you’re not able to rely on bonds for a return. If bond yields are moving higher then this should be interpreted as higher future returns. Plain and simple. There is without a doubt a period of decline in principal given the inverse relationship, but it’s relatively short lived. If your investment period outpaces the cycle of rising rates, then you’re a net beneficiary of the moves in the bond market. As time goes on and the debt you won matures, you now are able to reinvest at a higher coupon.

While rising bond yields give alternatives to investors to generate return, that doesn’t completely wipe stocks out of the equation. Sure, the hurdle becomes higher for equities to surpass in order to justify their use, but that’s not impossible. Bond yields as measured by the U.S. 10-Year Treasury have more than doubled since their bottom in July of 2016 (from 1.35% to 2.73% at Q1 end). In that same time, the S&P 500 returned more than 25%3.

There is certainly no shortage of cause for volatility with moves within markets like this. Investors are being given new fundamentals that they must weigh in their investment decision process. For one reason or the other, rising bond yields seem to spook a lot of investors. But maintaining a mix between the two asset classes still remains the course of action to help buffer from turmoil on both ends.

Looking Ahead

GFG Capital Market Insight Book Q2 2018[1][4]As we continue through 2018, investors are trying their best to understand exactly what they’re dealing with. Will the entire year turn out to be a statistical anomaly like the first quarter? Likely not; that’s what makes an anomaly an anomaly. We don’t think it’s reasonable to expect equities, bonds and commodities to continue to erase capital from investor’s portfolios in unison. We don’t see structural threats to the current economic backdrop that pose immediate threats that would warrant that. Not to mention, in a true flight to safety, we’d expect bonds to assume their traditional role within a portfolio. But like we mentioned, there are some pieces of evidence that have caused us to dig deeper than the rhetoric being sold to us.

GFG Capital Market Insight Book Q2 2018[1][4]As we continue through 2018, investors are trying their best to understand exactly what they’re dealing with. Will the entire year turn out to be a statistical anomaly like the first quarter? Likely not; that’s what makes an anomaly an anomaly. We don’t think it’s reasonable to expect equities, bonds and commodities to continue to erase capital from investor’s portfolios in unison. We don’t see structural threats to the current economic backdrop that pose immediate threats that would warrant that. Not to mention, in a true flight to safety, we’d expect bonds to assume their traditional role within a portfolio. But like we mentioned, there are some pieces of evidence that have caused us to dig deeper than the rhetoric being sold to us.

After a quarter of negative returns, valuations have been addressed to some degree, but we think there is room for further compression before the market is fully on board with equities again. Coming into the year, the S&P 500 was trading at nearly 18x forward earnings. Today, the valuation sits at 16.5x4. The price compression has addressed the “P” in the P/E ratio, and we’re still confident in the “E” continuing to grow. All eyes will be on earnings coming into start the second quarter. Expectations remain for double-digit earnings growth for the year on an index level. If we continue to see a sideways trending market, we think that would be a net benefit to investor’s psyche. That would mean the elevated forward valuation that was placed on equities coming into the year was justified, and moving forward, valuations would continue to be contained.

For our full second quarter report, click here.

SOURCE: This presentation is solely for informational purposes and should not be taken as investment advice. For further information, please contact one of our investment adviser representatives. Chart provided by GFG Capital. Charts made by GFG Capital. 1 Bloomberg. 2 Barron’s. 3Bloomberg 4Fact Set.

LEGAL STUFF

THIS PRESENTATION (THE “PRESENTATION”) HAS BEEN PREPARED SOLELY FOR INFORMATION PURPOSES AND IS NOT INTENDED TO BE AN OFFER OR SOLICITATION AND IS BEING FURNISHED SOLELY FOR USE BY PROSPECTIVE CLIENTS IN CONSIDERING GFG CAPITAL, LLC (“GFG CAPITAL” OR THE “COMPANY”) AS THEIR INVESTMENT ADVISOR. THE OPINIONS CONTAINED HEREIN ARE NOT RECOMMENDATIONS.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF GFG CAPITAL AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT A PROSPECTIVE CLIENT MAY DESIRE. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF GFG CAPITAL AND THE DATA SET FORTH IN THIS PRESENTATION. FOR A FULL DESCRIPTION OF GFG CAPITAL’S ADVISORY SERVICES AND FEES, PLEASE REFER TO OUR FORM ADV PART 2 DISCLOSURE BROCHURE AVAILABLE BY REQUEST OR AT THE FOLLOWING WEBSITE: HTTP://WWW.ADVISERINFO.SEC.GOV/.

ALL COMMUNICATIONS, INQUIRIES AND REQUESTS FOR INFORMATION RELATING TO THIS PRESENTATION SHOULD BE ADDRESSED TO GFG CAPITAL AT 305-810-6500.